|

My top 3 personal goals are:

- ___________________________

- ___________________________

- ___________________________

My top 3 financial goals are:

- ___________________________

- ___________________________

- ___________________________

It’s that time of the new year again… so here are our TOP TEN TIPS to help YOU achieve your financial goals in 2017. Follow them through and this might be the year that makes a BIG difference to your financial future!

1. Revisit or redo my budget

Email us for our budget organiser to help you get started!

___________________________________________________________________________________

2. Save 10% of my earnings

Direct debit into a separate higher interest savings account to avoid unnecessary or emotional spending temptations. Or, if you have a mortgage, these savings may be better served by depositing them into your mortgage or offset account (providing you have the discipline to not spend them!)

___________________________________________________________________________________

3. Pay off my ‘bad’ debt first

‘Good’ debt is used to purchase assets that are likely to earn income or increase in value over time – assets such as your house and investment properties. ‘Bad’ debt is used to buy goods that devalue, such as cars and TVs. If your current debt is mostly bad debt, then pay off the credit card or loan with the highest interest rate first. Once paid off, allocate that amount to your next debt until it has all been paid off.

___________________________________________________________________________________

4. Make extra payments on my mortgage

If you’ve paid down your ‘bad’ debt then it’s amazing how increasing the frequency of payments from monthly to fortnightly or even weekly will save on interest, provided you maintain the same total payment for the month. If you can afford more – even better! Call the office and we can let you know how much interest you could save over the life of your loan. You may be very surprised what a difference it can make.

___________________________________________________________________________________

5. Find ways of saving money or earning more money

There are only two ways to improve your financial situation – either earn more or spend less. If your budget is already cut to the minimum, think of ways to increase your income.

___________________________________________________________________________________

6. Consolidate my debt

By transferring your debt into one easy payment, we can help you reduce your total repayments and work out a plan to eliminate your debt and get ahead financially. We may consider consolidating all of your debt (credit card balances, personal loans, car loans etc) into one loan with a much lower average interest rate. If you are a home owner your home loan usually has the lowest interest rate. As always, your individual circumstances should be considered as part of any finance strategy so make sure you talk to us first!

___________________________________________________________________________________

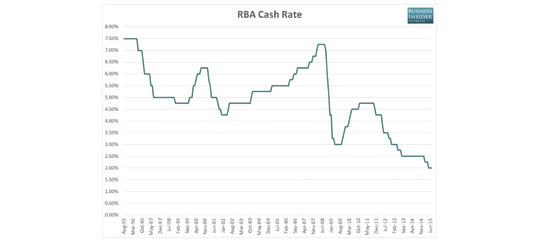

7. Consider your first or another investment property

Building wealth and financial security through property investment has ALWAYS required a level of sacrifice and self-discipline. Those who benefitted over time are those who put a strategy in place and had the discipline to stick with it. Again, talk to us FIRST so we can consider your personal circumstances and perhaps help you explore your options.

___________________________________________________________________________________

8. Update my insurances: income protection, trauma, life etc

In the event of illness, accident or accidental death, most families find themselves underinsured. Don’t let this happen to you. Call the office and we will recommend a trusted adviser to help you with this.

___________________________________________________________________________________

9. Get the best out of my superannuation

Review your superannuation. Research any potential ‘lost’ super from previous employer contributions. Consider consolidating separate super accounts into one. Make sure your investment risk profile matches your current retirement timeline.

___________________________________________________________________________________

10. Teach my kids about money

First you need to be a good role model. It’s never too early to start creating good money habits to help your kids with THEIR financial future.

|