|

If you are a potential first home buyer (FHB) you may be feeling disheartened by doom and gloom in the media as to whether younger generations will ever own their own home.

There is no doubt the house price to salary ratio was lower in the 70s and 80s – often seen as an unfair advantage for baby boomers. On the other hand interest rates by the late 80s were at times crippling – who remembers 17%?

Anyone who rode out 17% interest rates probably thought they would NEVER pay off their home. But they DO. And they DID. Historically, property prices usually rise over time. Surprisingly most home owners end up coping with market fluctuations, bringing up children and still doing okay.

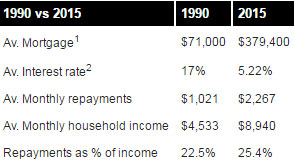

As you can see, even with a significantly lower average mortgage in 1990 home owners weren’t much better off while interest rates were high.

So what else has changed?

In 2016 we earn much more but other lifestyle factors have also changed. Finance is more readily available – how many of us now have credit cards? We’ve also moved on from a society that generally lived within their means. We no longer save or lay by – it’s often easier and more instantly gratifying to charge to a credit card!

Household mortgage debt has tripled in the last 25 years. One survey links the trend of increasing debt to the introduction of mortgage packages that allow homeowners to draw down on their mortgage without having to sell their house3. While this facility can be a helpful low interest way of accessing finance it can also increase the level of debt for those who don’t use it with care.

So what is the ‘home ownership’ message from all of this? Well, the road hasn’t ever been easy. In fact…

If it was easy – everyone would do it!

Building wealth and financial security through property investment has ALWAYS required a level of sacrifice and self-discipline. Current home ownership statistics show 31% of Australians rent, 36% have a mortgage and 33% own their home outright. Those who benefitted over time are those who put a strategy in place and had the discipline to stick with it.

Is there hope for first home buyers?

Recent research shows Gen Y is the new generation of FHBs and they are starting to actively enter the market. We are also seeing the rise of the ‘rent investor’ – young renters under 30 purchasing investment properties in affordable areas while renting where they WANT to live.

So yes, it appears there IS hope for FHBs. Do you want to be one of them?

Buying a property takes preparation and planning – sometimes for years. So what can you do NOW to help you buy a home in the future? Here are our top tips:

- Research the market NOW and plan your goal

- Work hard at saving a deposit

- Pay your bills on time

- Eliminate debt

Travel, good times and job-hopping have been the typical lifestyle choices of Gen Y but this generation is evolving. PREPARATION and PLANNING are essential to getting a foot on the property ladder along with reining in extravagant living and our penchant for instant gratification.

With a little sacrifice and self-discipline it may be more possible than you think for our younger generations to afford property. It may be even MORE affordable for Gen Y because there are possibly TWO salary earners to buy the first property – unlike back in the 70s. Let’s prove the doomsayers WRONG and take responsibility for our future!

And lastly speak to a finance specialist!

Contact us for a free consultation. It’s our job to assess your situation and ensure you are ‘mortgage ready’ BEFORE YOU START a loan application process. That’s VERY important!

Let’s team up and make it happen!

|