|

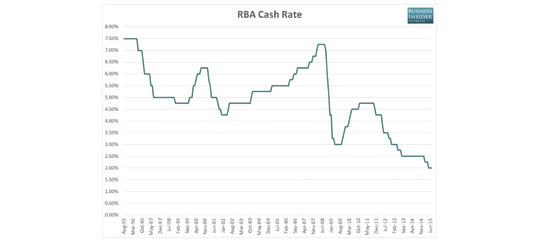

‘Bottom of the curve’ is a term often used to describe the point where interest rates may have hit their lowest point over a period of time. The Reserve Bank of Australia (RBA) began dropping the cash rate in November 2011 eventually reaching an all-time historical low of 2.00% in May 2015 – where it has remained.

There has been much debate in the media and amongst economists about whether the RBA will drop the cash rate even lower. Australia has enjoyed low and relatively stable interest rates for so long now it is tempting to think they will continue forever.

How has the market changed?

The cash rate and the big banks

The RBA is responsible for formulating and implementing monetary policy to achieve the objectives of meeting inflation targets, stabilty of the Australian currency, full employment and the economic prosperity of the people of Australia. Historically, interest rates set by the banks have tended to move in line with the RBA cash rate however in recent years a number of lending institutions have moved interest rates independently of the RBA cash rate decision.

There is no longer any guarantee banks will lower interest rates in line with the RBA cash rate decision…

In fact we have recently seen various lenders raising interest rates despite the cash rate remaining low.

Investment property loans

There were also some key changes to investment property loans in 2015 including:

- generally stricter criteria to approve investor loans

- cuts to interest rate discounts for investment loans

- deposits increased – up to as high as 20% (previously as low as 5% for investment loans)

- reduction in the amount of rental income considered when assessing an applicant’s income

Probably the biggest impact is that property investors will now require larger deposits as banks restrict LVR (loan to value ratio). It is important to remember interest rates are at their lowest level in history. Depending on your personal circumstances it may still be a good time to invest in property despite the tightened lending criteria and larger deposit required. Remember there are still some lenders that often have softer lending criteria – we can help you with this.

So where will it go from here?

Nobody really knows but be aware that rates are cyclical – at some point they will eventually start to rise again. The concern is that last time the cash rate began to rise a significant increase occurred over a relatively short space of time. We all know that generally when the cash rate increases, so do interest rates. During the last rise many institutions consistently increased interest rates above the cash rate.

What does this mean for home owners?

The best advice? Don’t wait until rates start to increase to review your finances. Your financial situation is ever changing – as are both the finance and housing markets. It’s prudent to periodically review your mortgage and finances.

As your finance specialist it is our job to stay well informed on the changing landscape of lending so we can continue to offer you up to date information. We do the research for you then help you assess your options.

Ensuring you still have the most appropriate product shouldn’t be determined based purely on the rates on offer – it is important to have an expert explain the loan features of each product.

No one wants to go into arrears, or even worse, default on a mortgage. Everyone – especially first home buyers who have never experienced mortgage stress – should speak to a mortgage broker or financial adviser about the appropriate strategies for their situation. It pays to put contingency plans in place before the inevitable rises occur.

|