articles

Underinsured? – What’s the worst that could happen?

An industry report has revealed Australia is highly under insured compared to most developed nations – especially when it comes to income protection and life insurance.

It is an ongoing problem that could affect many of us AND even more importantly – our families. The report1 shows:

• 95% of families don’t have adequate insurance

• One in five families will be impacted by the death of a parent, serious accident or illness that leaves them unable to work

• The typical family will lose 50% or more of their income after a serious illness, injury or loss of a parent due to underinsurance

The matter is also a grave concern for the government who expects multi-billion dollar blowouts to health and welfare budgets in coming years. And we ALL end up paying for that!

How does this affect families?

A recent study found up to 60% of Australian families with dependants didn’t have enough life insurance to care for the family for more than 12 months if the main income parent was to die. That’s a very worrying scenario.

Why DON’T we insure ‘US’?

There are several theories here. One theory is that our typical Australian ‘she’ll be right’ attitude contributes to our complacency. This approach might serve us well in everyday life but it won’t pay the bills in situations that might normally be eased by insurance benefits.

Another theory is that when we are healthy – or lack a family history of serious illness – we tend to think ‘it won’t happen to us’. That is, until something happens…

It seems the inclusion of life insurance cover in superannuation funds may also have given many of us a false sense of security that our super fund will provide all the protection we need. In reality, the average compulsory death cover payout provided by super funds is around 20% of average needs. Have you checked your cover lately?

‘Most of us don’t investigate our current insurances until after an event occurs – which is TOO LATE.’

Common insurance myths

There are several insurance ‘myths’ that may contribute to the problem. These include:

You only need insurance if you’re in poor health. It is estimated 20% of the population between 21 and 64 will suffer an unforeseen event that will render them incapable of work.

Total and permanent disability insurance (TPD) is another insurance type that will provide cover for serious and permanent disablement. In any event, wouldn’t you prefer your family had peace of mind?

Insurance is expensive. This is probably the primary reason for underinsurance. In reality, practices such as purchasing policies when young and taking advantage of various tax benefits – especially if you are self-employed – may result in insurance being more affordable.

If having no insurance – or being underinsured – should result in your family’s monthly income being halved or the need to sell off family assets to survive, perhaps the cost of insurance may not seem so high after all?

The government will look after us. With almost 80% of Australians on government benefits and around 66% of retirees solely dependent on the pension, it’s clear that a lot of us probably think that way.

Sadly, it is unlikely government benefits will provide for you or your family comfortably.

If you are unsure

Seek advice from a professional. If you believe you are unable to afford the appropriate policy, a professional will be able to shop around for a number of quotes and consider alternatives such as increasing the excess to reduce the premium.

Clearly being well prepared is important and will provide greater certainty at a time that will already be stressful.

Crushing credit card debt – Choosing the option that works for YOU!

The festive season is over but some of us may still have that warm glow from indulging our loved ones and perhaps even enjoyed a relaxing summer holiday. What wonderful memories…

So how is the credit card balance looking?

In Australia, over 70% of adults have at least one credit card. With nearly 17 million credit cards in circulation1 chances are this is also the time of year when some of us have to face the reality of our extravagance – in black and white on our credit card statement.

Options for credit card debt

What’s the best way to clear credit card debt? This will depend on your level of debt, the number of cards and your individual circumstances, however your choices might include:

• paying out the balance in full before interest accrues

• paying the maximum amount you can afford each month to clear the debt as quickly as possible

• (if you have more than one card) paying at least the monthly minimum on each card while allocating a larger payment to the card with the highest interest

• transferring your balance to a new credit card offering a lower interest period

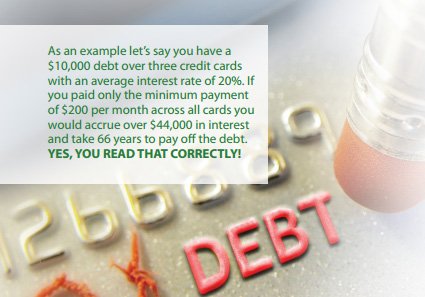

• consolidating your debt into your home loan At all costs you should avoid paying ONLY the minimum monthly repayment or you could be in a cycle of debt that is NEVER resolved.

At all costs you should avoid paying ONLY the minimum monthly repayment or you could be in a cycle of debt that is NEVER resolved.

Clearly, having a plan to repay credit card debt as quickly as possible is the best option…

Credit card balance transfers

Many lenders now offer credit card balance transfers with a range of rates and offer periods. You transfer the balance from your existing credit card to a new card at a lower (or even zero) interest rate for a set period to provide ‘interest breathing space’ to help you to pay off your debt quicker.

To ensure a credit card balance transfer works for YOU it is essential to know the terms and conditions of the card AND to be disciplined with repayments.

What should you know?

• To maximise the benefit you should pay ALL the transferred balance within the offer period.

• Know the offer end date! If possible set auto payments each pay that will clear the debt before that date.

• Any transfer balance at the offer end date will attract interest at the card’s standard interest rate.

• New purchases usually attract the standard interest rate – NOT the transfer interest rate.

• Know what fees apply and when they fall due, eg annual fee or percentage of transfer amount.

MOST importantly, cut up your old card(s) so you are not tempted to rack up even more debt while paying down the original debt!

A balance transfer should NOT be used habitually to manage recurring periods of debt! Poor financial habits and/or multiple credit enquiries may negatively impact your credit score – even if the enquiry didn’t proceed. This could influence your ability to be approved for a home loan in the future!

There IS another way…

Together we may consider consolidating all of your debt (credit card balances, personal loans, car loans etc) into one loan with a much lower average interest rate. If you are a home owner your home loan usually has the lowest interest rate.

Choosing YOUR best option should involve creating a budget, being brutally honest about your self-control when it comes to spending and repayments and then finding the fastest and lowest interest option to clear your debt. Need help? Give us a call TODAY

Can you manage a mortgage and a baby

As new parents, we are often caught off guard when our organised life becomes a thing of the past after we bring home our bundle of joy. It’s amazing how tiny babies can turn our household upside down. We quickly learn to be more flexible about when we eat, sleep, go to the shops and even shower!

As new parents, we are often caught off guard when our organised life becomes a thing of the past after we bring home our bundle of joy. It’s amazing how tiny babies can turn our household upside down. We quickly learn to be more flexible about when we eat, sleep, go to the shops and even shower!

It helps to be flexible in our financial life too when the impact of reduced household income and the expense of a new addition starts to be felt.

We’ve all heard it said, “there is never a right time to start a family” – whether it be for a career, personal or financial reasons. Still, many of us go ahead anyway and are then forced to stick to a tighter budget. But somehow we find ways of ‘making it work’.

Most of us can save money when we have to, however, it’s often less stressful if we’ve done all we can to AVOID financial stress. We don’t want financial worries when we’re sleep deprived and trying to settle a crying baby.

A little planning BEFORE baby arrives can make it easier to focus on what’s important later… our family.

Planning is the key to relieving the financial pressure of starting or increasing your family. The more time you have the better, but even if the baby is unplanned you have at least seven months to prepare! Here are some great ideas to get you started:

1. Be ready before baby arrives

Shopping and preparing your home for a new baby is fun but you should also consider taking steps to prepare your finances while there are two incomes – such as pay off the credit cards, look for options to earn extra money (eg overtime), set up a ‘rainy day’ account for unexpected expenses. It’s also a good idea to trim expenses or stockpile cleaning products, non-perishables or gifts before your budget tightens.

2. Budgeting

If you don’t have a budget now is a good time to create one. It’s often surprising to see where your money is going but it certainly helps you work out where you can cut back.

3. Practice living on one income

Consider trying to live off one income as soon as you find out the baby is coming. On pay day immediately bank the second income into a savings account and see how you go managing your expenses. This is a great way to identify where to cut back in order to manage after baby arrives.

4. Know your leave entitlements

This might include paid parental leave from your employer or up to 18 weeks parental leave pay1 from the Australian government. If your employer offers paid parental leave you may be able to take half pay for double the time. Or perhaps you are able to use accrued annual or long service leaves stretched out over time if taken at half pay? It pays to ask.

5. Take the pressure off

If buying a new home perhaps consider borrowing less than you can afford. Making higher repayments before baby arrives may allow you to make minimum repayments after you drop to one income. If your loan has an offset account, use it for the extra payments – you’ll reduce your loan interest but still have easy access to the funds after baby arrives.

How can we help?

We are happy to spend some time with you to make sure you have all the information you need to plan ahead! For example, we can:

• explore if your current loan has access to any flexible options

• research lenders that offer loan features suitable for your individual circumstances

• calculate loan repayments on properties of various values to determine affordability

• investigate if you will still be eligible for the finance you want if one of you stops working

• find out which lenders offer a ‘repayment holiday’ to suspend repayments while one partner is not working

• work out how much you need to pay ahead on your loan to cover repayments during maternity leave

• discuss the possibility of refinancing your current debts to reduce monthly repayments

Should I refinance my home loan regularly?

It’s interesting that when our home or car insurance is due for renewal most of us invest time to shop around and check we’re still on a good deal. Yet we hesitate when it comes to reviewing our home loan!

With the RBA cash rate at an all-time low and lenders continually offering new rates and loan products we are often asked by clients WHEN and WHY they should review their loan.

With the RBA cash rate at an all-time low and lenders continually offering new rates and loan products we are often asked by clients WHEN and WHY they should review their loan.

Gone are the days when we stayed with the same loan or lender for the full 25 or 30-year term of a home loan – the mortgage market is now very competitive.

Regardless of a changing landscape, any decision to refinance your loan should consider your individual circumstances, your current needs AND your future financial goals. As your finance specialist that’s where we can assist!

Q. When should I consider refinancing?

You might think refinancing is simply a good way of reducing your loan repayments. But there are also ‘life events’ that could be a worthwhile reason to review your finances. These include:

Increased equity in your home

Perhaps it’s time to consider an investment property?

Children starting school

It’s not unusual for parents to spend between $10,000 and $19,000 on long day care. What will you do with your savings once you are no longer paying fees?

Re-entering the workforce

With kids off to school maybe mum has gone back to work? Any increased income is a good reason to review your finances and perhaps even consider investing.

Finally paying off your car loan

Before you buy a new car do you realise that the same amount you pay for your car loan each month could possibly give you the opportunity to enter the investment property market?

Children finally leaving the nest

What a great time to ensure you are effectively planning your retirement income and lifestyle.

Q. What benefits may result from refinancing?

Lower rate = lower repayments Maybe. However, any decision to refinance should not be based solely on a lower interest rate. Your long-term goals, as well as current needs, should be considered. Switching to a lower rate while maintaining your current higher repayments could significantly reduce your loan term and total interest over the life of the loan. You should also consider the costs associated with refinancing to determine the overall benefit. As your finance specialist, we will explore your personal circumstances to determine if refinancing is suitable for your particular situation.

Improved loan features

If you’ve had your home loan for a few years refinancing may provide new loan features that will allow more flexibility such as Repayment flexibility – the ability to make extra payments could also result in a reduction of the loan term and interest payable. Redraw facility – allowing you to redraw from your extra payments when required. Flexible rates – switching between a variable and fixed rate or splitting your loan between the two may assist you to manage your mortgage in line with interest rate movements. Portability – taking your loan with you if you move could save on fees.

Eliminate features you don’t need

Perhaps you no longer require some features of your current home loan? If so it may be worth talking to us to explore loan products more suitable for your current situation.

A loan with extra features will generally attract a higher interest rate and a ‘no frills’ loan will have a lower rate. Suitability will depend on your individual financial situation and the overall benefit provided by a product. Is it worth paying extra for features you don’t require?

Q. How often should I review?

We recommend an annual home loan check-up. Sometimes we can improve the financial position of our clients and sometimes you will already be in an appropriate loan for your situation. A quick call will allow us to give you comfort that all is still good (or not) with your finance. Wouldn’t you like the reassurance of knowing?

Will you be renting for the rest of your life?

Perhaps not…

With the ongoing concerns about increasing property prices, home ownership, the cost of living, and small or no wage increase, the question that continues to come up in general conversation is ‘how will our children ever enter the property market?’

Did you know that approximately 28% of our Australian populations at any time are in rental accommodation?

The percentage of owners (including those with a mortgage) vs renters has not changed significantly since the very first census of population and housing in 1966. In 1966 the proportion of owner occupied private dwellings vs rental was 71.4%. The most recent census information of 2006 shows home ownership has dropped slightly to 69.8%.

Although there has been a slight drop in home ownership, the population has more than doubled over the same time from 11.65M to currently over 23.8M. In fact, home ownership rates in Australia still put us in the top five of all OECD countries.

So what can renters do?

Home ownership

The legal rights and obligations that home owners have in relation to the property they live in vary considerably according to the type of housing.

For example, those who own their home:

• have greater security of tenure than most renters whose occupancy rights are subject to review at relatively frequent intervals.

• generally have more freedom than renters to modify the property to suit their specific needs and tastes (eg to keep pets, take in boarders or run a business from home).

In the course of repaying their home loan, owners usually accumulate wealth in the form of home equity that can then be used to secure finance for other purposes.

Conversely, they face considerable costs associated with buying and selling property, so home owners have less flexibility when it comes to moving house.

Renting

On the other hand, renting can have advantages over home ownership, such as:

• Greater flexibility to move elsewhere at short notice,

• Lower housing costs than many owners repaying a mortgage,

• The opportunity to invest in other assets which may yield higher returns than home ownership, plus

• renting avoids repair and maintenance costs, rates and insurance bills that are all part and parcel of home ownership.

Can you rent AND buy?

Sometimes it makes more sense to become a renting investor, i.e continuing to live in rental accommodation and buying an investment property before buying a home. Young investors, in particular, may do this for a number of reasons:

• They can rent in the trendy, lifestyle driven areas they want to live – but cannot afford – and still get a foot in the property market. An investment property may not necessarily be in the area – or even state – that they want to live but can be chosen purely for affordability and good rental returns.

• They may still be living at home with their parents rent free, enabling them to save and invest.

• Their lifestyle is still transient – travelling, moving around with jobs or relationships. They may not be sure where they want to plant their ‘property roots’ yet.

• They don’t see a large, non-tax-deductible mortgage on a home as the best use of their money at this stage of their life.

Co-ownership scenarios may be another option for younger buyers. Pooling financial resources with family or friends may allow them to enter the property market faster than they would be able to do on their own. However, this option is a little more complex than a typical individual owner/occupier or investor purchase so you need to establish a borrowing arrangement to protect your investment.

Save, Equity or Super

What will be your path to prosperity?

Investing in property is something that most of us think about doing, want to do or hope to do. However only around 20% of Australians ever actually do it.

Why is this still the case when we know:

- our super payout may only pay out our mortgage on retirement,

- our savings won’t be enough to live on in retirement, we will have to severely reduce our lifestyle AND will most likely require some form of government assistance,

- we need to get ahead financially now, not later, and

- property prices won’t be any cheaper in 10 years’ time?

Is it because:

- we don’t know how to take the first step,

- we are scared to make a decision in case we get it wrong,

- we don’t think we can afford it (although we’ve never investigated it with our mortgage broker to see if we can),

- our friends and family tell us it’s a bad idea (and they would know because…?),

- I’m only renting, so how on earth can I afford an investment property,

…or is it that we are STILL waiting for the right time?

Whatever the reason, there is more than one way to get started on the investment property ladder.

Let’s have a look at few options…

1) The good old… save a deposit

The most straightforward method of making a property purchase is to save a deposit.

Prior to the GFC, it was possible to borrow 100% of an investment property value. Then for a few years, lenders were quite tough on lending criteria requiring 10-15% of the property value (subject to lender’s mortgage insurance – LMI) combined with more stringent servicing requirements. Over recent years Australia again saw lenders relax the lending criteria leading to substantial growth in the property investment sector.

As of May 2015, under pressure from APRA1, lenders once again tightened lending criteria for investors. This includes a range of measures from increasing the minimum deposit to 20%, increasing interest rates for investment loans2 and reducing the amount of rental income included when assessing an applicant’s income. These measures may vary between lenders. So what is the message here? The bottom line is the investment property market ebbs and flows over time. There is not necessarily the BEST time to get started. And let’s not forget that interest rates are currently still at an all-time historical low.

This is one area where a mortgage broker can really add value to their clients. They assess a number of lenders for variables such as interest rates, LVRs and discounts being offered for investment property loans and can help you find the best solution for your particular circumstances.

So what else can you do?

Ask your parents to help

You may have a parent who is willing to give you a lump sum gift to help you on your way.

Use your rent as a savings plan

Most lenders now acknowledge the money that you are currently paying in rent could be used to show your ability to save and capacity to service a loan. This is referred to as non-genuine savings.

Criteria vary across different lenders, so we can help assess your individual circumstances. In general having a continuous rental history of 12 months (regardless of the amount of rent paid) will help show a proven saving record.

If you have a 3-month rental history, you can also include second tier deposit sources to make up the required deposit amount.

Second tier sources are:

1. Commission payments,

2. Dividends,

3. Inheritance,

4. Non-real estate asset sales, and

5. Tax refunds.

Borrow with family and friends

It is becoming more popular to share the costs and investment with other owners and up to 30% of co-owners are now investors.

2) Use the equity in your home/other property

If you are already repaying your own home or have an investment property, you may have enough equity to access a deposit for your next property purchase by tapping into this equity.

I’ve heard that before but how does it work?

The ultimate goal for the typical Australian is to own their own home. So when someone suggests to them “Why not use the equity in your home to purchase your investment property?” alarm bells ring in

most people’s heads.

We tell ourselves:

But we’ve worked so hard to pay off our home loan. Why would we jeopardise that?

• I’m too scared. I don’t want to lose my home.

• What happens if one of us loses our job?

• I’ve heard that tenants wreck your property.

The reality is that sometimes it is actually safer to purchase an investment property as most of the expenses are covered by the tenant and the tax man. With good insurance (landlord, mortgage and some risk insurance) most people are usually safe. Of course, you need to purchase using essential investing criteria to ensure your investment is going to be a good one. We can help you with that.

So how does using the equity work?

The basic principle is that if you have enough equity to draw from your existing home for a deposit and purchase costs, then you can redraw that amount from your home and use it as your deposit for the investment property.

Your lender is going to require the total loan amount (balance of your existing home loan and investment redraw amount) is less than 80% of the value of your home otherwise lender’s mortgage insurance (LMI) is required.

Provided that you, the tenant and the tax man can service all debt, you will be on your way to building your investment property portfolio.

You can continue to use this basic principle every time you build enough equity in the combined value of your properties.

3) Self-managed super funds (SMSFs)

Changes to superannuation legislation have made it possible for your SMSF to borrow to invest in real estate. Potential benefits when using an SMSF to invest in property may include:

• The SMSF portfolio can be diversified to include real estate with a direct residential property investment not solely through a managed fund.

• You may be able to reduce the loan faster by salary sacrificing additional funds to make repayments.

• The trust can offset the loan’s interest and other expenses against rental income from the property. This could result in potential tax deductions depending on the particular circumstances of the SMSF.

• Lender’s recourse is limited to the property itself. Other assets within the SMSF are not put at risk.

Purchasing a property by an SMSF is slightly different to purchasing a property directly. The steps to follow are:

Step 1 The trustee of your SMSF selects a residential investment property to purchase.

Step 2 The trustee of your SMSF appoints a custodian to purchase the residential investment property on its behalf.

Step 3 The trustee of your SMSF applies for a super fund home loan and provides documentation to the lender.

Step 4 The custodian pays the deposit and exchange contracts on the purchase of the residential investment property.

Step 5 Your custodian mortgages the property to the lender to complete the purchase.

Step 6 The trustee of your SMSF pays the legal costs and stamp duty on the purchase.

Step 7 Once the loan is advanced, the trustee of your SMSF collects rent, pays the usual outgoings on the property and makes the loan repayments. The property is managed in the same way as any other real estate investment.

Step 8 The property is held in trust. Once the loan is repaid, the legal title may be transferred from the custodian to the SMSF or the property may be sold.

Some lenders offer specialist loan products specifically for super funds. Lending criteria will vary between lenders and may also be subject to the same current tightening of lending criteria as for other property investment loans.

We can help you locate a lender that is suitable for your particular situation.

There are some considerations in setting up an SMSF.

• SMSFs are strictly regulated by the ATO.

• Operating a fund is a complex task and obtaining specialist advice is recommended before proceeding.

• If you do set up a super fund you must carry out the role of the trustee. This involves significant time, expertise and money.

• One major concern when purchasing a property through an SMSF is that should the property be vacant with no rental income, the mortgage repayments must be funded through other investments held by the SMSF.

Property investment is a proven road to personal wealth regardless of the route taken. If you would like to discuss any of the above methods or other options to purchase an investment property for your personal situation, please call the office today.

About 20% of Australians successfully invest in property outside the home. About 80% of Australians require government assistance on retirement. Now is that just a coincidence?

Top 15 ways to own your home sooner

Before taking action on any of the below ‘Top 15 Ways’, we recommend you speak with a finance specialist. Call the office for more information on any of these 15 suggestions.

1) Pay the first home loan instalment as soon as you settle

2) Review your loan at least every couple of years and negotiate a cheaper rate with good flexibility

3) Ensure you use a mortgage offset account for your savings

4) Split your loan – fix some and the rest flexible

5) Avoid redrawing money off your mortgage

6) Don’t lower your minimum regular payment if interest rates fall

7) Set your repayments higher

8) Make lump sum repayments or regular mini lump sum repayments

9) Pay your loan fortnightly rather than monthly

10) Set a budget and reduce any unnecessary spending

11) Pay loan fees upfront

12) Align your repayments with your income cycle

13) Make extra payments – preferably set up an auto payment

14) Look for loans that offer features without a charge

15) Check your loan fees

No Leave No Life

Finding balance in a busy world

We Aussies enjoy taking annual leave, so why is it that so many of us have accumulated a lot of leaves that is screaming out to be used?

Are employers being too tough and refraining from approving leave? Or are we letting everyday life and work commitments get in the way of planning for longer term events?

Maybe the cost of a holiday is simply becoming too expensive to justify spending our hard earned cash?

It is staggering that the 7.7 million1 full-time workers in Australia have accumulated 123, 510, 0002 days of annual leave. That’s an average of just under 21 days – or almost a calendar month – that those workers could be spending relaxing and doing as they please!

Even more interesting is that 28% of the total workforce has over 5 weeks of accrued annual leave.

Stop and look up

Rather than trying to understand why people are NOT taking leave perhaps we should look at the benefits of taking leave? Recent research3 indicates changes in career and jobs aren’t always triggered by events that occur at work. Surprisingly, personal events such as major birthdays, reunions and holidays ranked quite high on the list.

The theory is that these personal events often cause people to rethink their life and what they are doing. This was particularly true where they spent these times with other people and had the opportunity to make a comparison. In other words, until people take some time out of their everyday life (going to work) they don’t have time to assess what they are doing – and why.

Recharge

According to the ABS, around 5 million full-time workers regularly work more than 40 hours per week. That’s 65% of us! So it’s not surprising that people who DO NOT take leave tend to be unhappier at work and have higher stress levels. On the other hand, those that DO take leave not only tend to be happier but are also more productive. It’s been shown that there is a strong correlation between workers’ levels of happiness and their ability to operate at peak performance. Don’t forget, when you’re operating at peak performance you are more likely to be considered for that promotion or pay rise.

Finding the balance

So why is it that so many of us don’t always take our annual leave?

We need to find a balance between the cost of taking annual leave and the benefits that result from taking annual leave.

Most importantly we should always strive to live within our means. An extravagant overseas holiday or that trip of a lifetime may deliver instant happiness, however, this happiness may be short lived if we return with a mountain of debt that holds us back and causes stress well into the future.

Let’s consider… Is there a return on investment from taking annual leave? A relaxing break on annual leave may allow you the time to contemplate:

- Your next career – that could lead to improved happiness and higher earnings,

- Your financial objectives and how you might achieve them through future investments, or

- Lifestyle choices, including where you really want to live.

Taking leave is important!

Aim not to be in the 50% of workers with more than 4 weeks of accrued leave! Taking your leave regularly allows you to recharge the batteries and take the time to consider where you are and what you want to be doing.

The Great Tree Change

Priced out of city property markets?

Many first-time property buyers are finding it increasingly difficult to enter the market as property values in most capital cities continue to rise. Some realise their best financial option to enter the property market is with an investment property but for others, the emotional stability of owning and living in their own home has higher priority.

As a result, many younger families are now looking at alternative locations where they can live the ‘great Australian dream’.

Families are following the trend set by many retirees and are moving to regional and coastal areas.

Certainly, the concept of a tree change or sea change is nothing new. What is new is that statistics are now indicating migration to lifestyle markets is being driven by young families.

Embracing a new lifestyle

There can be a lot to love about a new lifestyle away from the frantic pace of the city. Just some of the positive aspects of a tree/sea change are:

• A greater sense of community

• A quieter and more peaceful life

• Possible space to grow your own produce and become more self-sufficient

• improved health due to fresh air, healthy living and less stress

• A more relaxed lifestyle for kids with far less pressure to keep up with a host of extracurricular activities.

A leading demographer claims the move to lifestyle markets reflects the greater satisfaction we demand in our lives these days2. Gen X is leading the way by proving to be a generation prepared to accept a less materialistic lifestyle for more time with family.

So if improved lifestyle is your key driver then there is every chance such a move could see you joining the ranks of raving fans!

On the other hand, if lower cost is your key driver the decision may require more careful research and consideration.

Isn’t lower cost a plus?

Entering the property market at a lower cost can be a compelling argument for such a move. However, the same research also revealed one in five tree/sea change moves don’t work out and people look to return to the city.

You should consider the current and future needs of all family members. Acknowledging possible issues can help you to plan how you will manage problems if they arise. For instance:

• If the commute to work proves too difficult are there alternate work opportunities nearby?

• What are the capital growth prospects? How has the area performed to date?

• Are there schools, hospitals, transport and shopping venues nearby? What are the proposed future infrastructure plans?

• How will you maintain contact with family and friends? Will they be prepared to visit – and vice versa?

• Are there job opportunities for your kids? Many kids move out to pursue job opportunities further down the track.

• Most importantly, what will you do if it doesn’t work out? How will you get back into a city market?

The key to success

Thorough research is the key. Here are our top tips:

• Choose a location that will suit the lifestyle the whole family would like.

• Don’t rush in. Spend lots of time there – maybe rent first.

• Research demographics and population movement for a guide to future market trends.

• Understand the job market. You may need to be flexible.

• As a couple or family ensure you share the same vision.

• Complete a detailed financial plan. Wages will probably be lower and potentially some costs higher.

• Consider services you might require further down the track. Lack of healthcare is often a BIG factor in tree/ sea change moves not working out.

• Be prepared to get involved in the local community.

Are there alternatives?

Already own a city property? Perhaps consider renting out your city property and using the equity in your property to purchase in your chosen lifestyle market. Your city property will remain your backup plan until you decide a tree change is your permanent home.

First home buyer? Not sure if a tree change move will work out? Perhaps you could consider becoming a renting investor by renting in your chosen lifestyle market for a period of time but purchasing an investment property elsewhere?

If you are ready for a change we are here to help! We’d love to chat…

School’s Out!

The end that opens new doors

Some of us are excited by the end of the year as it means warmer weather and maybe even a summer vacation. For others, it can be an emotional time as children finish the school year for the last time and enter the adult world of more responsibility, employment or further education.

Some of us are excited by the end of the year as it means warmer weather and maybe even a summer vacation. For others, it can be an emotional time as children finish the school year for the last time and enter the adult world of more responsibility, employment or further education.

Letting go of the apron strings and facing the prospect of a less busy home can leave a big gap in the lives of many parents. It DOES, however, come with some benefits. After years of personal and financial support of your children, you can now refocus on your own personal and financial goals. Remember those? You used to have them!

A new start for parents

As children leave school – and in most instances start on their own path to financial independence – parents may find they are in a position to take advantage of savings now they are no longer funding School fees, text books, uniforms, tutoring, sporting activities etc.

We all know we should create a budget at least annually but often fail to do so. As kids complete schooling there WILL be a change in your budget – make sure your new found savings don’t get swallowed up in your daily lifestyle resulting in a missed opportunity.

How could these additional savings be used to create a successful financial future?

• Make additional mortgage repayments to pay off your loan sooner and save thousands in interest.

• Reduced expenses mean improved serviceability for a new loan that could fund an investment property. You could use the equity in your home as security for the deposit.

• Take advantage of superannuation thresholds that allow you to make additional contributions into super.

• Concerned about your level of debt? Talk to us about debt consolidation. A combination of lower interest and extra payments could see you get on top of debt in no time.

There are many other options, but regardless of the option, you choose there is no smarter decision at this time than investing in your future financial independence.

Don’t forget the children

This time SHOULD also mark the start of the journey to adulthood for our kids. While many will go on to tertiary education it is never too early for them to learn financial skills for the future.

What are some ‘mistakes’ we make with our school leavers that may undermine THEIR path to financial independence while continuing to impact our OWN finances?

- We pay for everything!

We think letting them live at home at no cost helps them get ahead when in fact we’re giving them a false sense of reality. Kids NEED to learn about everyday expenses and how to manage them. Solution? Charge board and have them contribute to utilities. Still, want to help them? Save part or all of the money to assist with a home deposit down the track.

- We pay their HECS-HELP loan

With student loan schemes currently interest-free, does it make sense to use your cash to pay a debt that attracts no interest? Even with an upfront discount, it pays to do the sums. If you were to consider purchasing an investment property instead, you could not only be building your own wealth but also it may put you in a better financial position to help your kids later. The other plus? Your kids will learn the concept of ‘user pays’ if they are responsible for their own student loan.

From school to independence

Personal finance is not taught at school or university – much of what we learn comes from our parents. Below are some of the basics every teenager should learn BEFORE they start earning money. They are:

1. Create a budget

As a rule of thumb, you should divide take home pay into 50% to essentials, 30% to lifestyle and 20% to savings.

2. Avoid ‘dumb’ debt

Credit cards can lead to financial disaster – it pays to be disciplined about use and repayments.

3. Look after your credit rating

Poor financial habits COULD impact your ability to qualify for a home loan in the future.

4. Talk about superannuation

Ensure your kids know about the role super will play in their future. It should be a focus from their 20s – not their 40s.