articles

Help From Friends

We all know that Australia’s housing market is one of the least affordable in the world1. Housing affordability is affected by many factors including changes in rising prices, household income levels as well as demand relative to supply.

An increasing number of Australians returning to co-ownership as a solution

Co-ownership allows a small group of individuals (friends/family/colleagues) to pool their resources and purchase property together.

This can be a great option for many individuals allowing them to step into or expand their existing property ownership earlier than expected.

The growing number of co-ownership purchases has encouraged lending institutions to develop specific loan products to support them.

This new way of financing allows the co-owners to operate separate loans secured against a single property, through a single lender. This offers the parties the ability to:

1. structure their loan portion in a way that suits their individual circumstances and requirements, eg you can select to fix a portion or have an interest-only repayment, make repayments while your co-owner may prefer a variable loan;

2. have a different share of the make repayments accordingly; and

3. borrow more combined than if the individuals applied separately.

The issue of joint and several liabilities for each other’s debts still applies.

In general, a lender will require that all parties guarantee each other’s loans. This means that if one party defaults then the property secured against the loan will be at risk should the remaining parties not be able to cover the full repayment.

Given these requirements, it may be worth obtaining mortgage protection insurance to protect the mortgage if one of the parties is not able to meet their repayments due to illness, death or temporary unemployment.

Co-ownership introduces more complexity than a typical individual owner-occupier or investor purchase and you should ensure that you establish a borrowing arrangement to protect your investment.

There are a number of benefits from entering into a co-ownership arrangement. This arrangement:

• allows you to enter the property market sooner as it is easier to save a deposit together;

• reduces the costs of entering the property market individually as the stamp duty, conveyancing costs and other upfront purchase expenses are shared and

• give the potential to borrow more for the property than if you applied individually for a loan as your borrowing capacity is pooled. This enables you to buy more with your money (a larger home, better suburb, more features and facilities…) than if you were purchasing your own.

Co-ownership can be used to purchase property of any type. In the housing market owner occupiers currently, makeup around 60% of all mortgage commitments and investment loans account for 40%.

A co-ownership agreement is recommended when entering into an aco-ownership purchase.

The agreement sets out a legal framework should a number of issues occur such as:

1. a party defaulting on payments,

2. how decisions relating to the property will be made,

3. how expenses will be shared,

4. a dispute resolution process, and

5. an exit strategy should a party wish to sell their share in the property.

Locating finance for a co-ownership purchase has been a tricky area in the past, but options have improved. With growing lender support, there are now more options available to make home ownership a reality for moreAustralians today.

If you have been considering a co-ownership option then we can help locate an appropriate lender for your personal situation and your prospective co-owner.

Young, single… and unprotected

If you are in retirement mode – and especially if you are thinking of downsizing -you may be looking at passing precious possessions to your children or grandchildren. There may be just one small problem….

Do they really want them? You COULD be in for a surprise!

Many of our younger generation are simply not interested in inheriting a lot of the items we hold dear. Tastes have changed – minimalist is ‘in’ and clutter is‘out’.

Gens Y and Z identify more with their current social profile than they do with family heirlooms from the past. They are also mobile generations, often choosing to work and travel abroad. Storing boxes of‘stuff’ is just NOT on their radar.

Where does that leave our precious‘stuff’?

It can be difficult to accept our kids don’t want our belongings but what matters to US is that they don’t end up going to waste.

So how do you downsize without your past ending up as junk? Here are our tips:

• Ask your kids/grandkids to choose one or two items they would really like and give them to them NOW.

• Donate furniture etc to charities or community programs so they go to someone who needs them.

• Scan photos and albums to create a digital photo book you can store and share online with your family NOW.

• Sell items you no longer want, need or have room for. Ebay, Gumtree local buy, swap, sell sites make it so easy.

A word of warning! Research their value first – you just might be selling something of great value.

Consult your financial adviser to explore any tax implications such as whether capital gains tax may be payable. It’s also a good time to make sure your will is up to date.

Young, single… and unprotected

Our younger generations have moved on from the ‘old ways’. Our articles in this issue about single, female first homebuyers and kids not wanting to inherit our ‘stuff’ are clear indicators they are determined to do it THEIR WAY.

Statistics show Gen Ys are generally marrying and having children later (if at all). They are also the most educated generation in history (a label that will soon be eclipsed by Gen Z). Most are well entrenched in the workforce with many enjoying relatively high disposable incomes.

So what DO they spend their money on? Well…

Gen Ys are now starting to enter the property market – whether it be as first home buyer singles or couples.

Statistics also show that 1 in 5 Gen Ys are now ‘rentvestors’, ie they buy an investment property while still renting where they want/need to live or living at home with parents. That’s a great start to building future wealth!

Others are still enjoying spending their disposable income on key interests of their generation such as technology,(lots of ) travel, good times and rangeof leisure activities they love. The world is certainly their oyster.

So what about their future?

Doing it their OWN way – and frequently on a single income – could lead to one very critical risk they may not have considered….

What happens if something happens?

How do they protect their future?

When you’re young you don’t think about the possibility of something going wrong. If you are single and you depend on YOUR income for all of your living expenses what would be your plan if that changed?

Have you considered income protection insurance? It just could be the type of insurance you are VERY glad you have IF you ever need it.

Want to know more?

The power is in your equity

INVESTMENT

Property investment has long been one of the more successful strategies to achieve financial independence, and yet statistics show only about 20% of us do it.

Property investment has long been one of the more successful strategies to achieve financial independence, and yet statistics show only about 20% of us do it.

Why has property been a strong contributor to wealth creation? In general terms, wealth is created through capital growth as your property value increases over time. Of course, this is only true if the capital gain on the property is greater than the cost of holding it.

Challenges in entering the market

It appears about 80% of us find it too difficult to purchase an investment property. The good news is that if you already have your first property – either your home or an investment property -you could already be on your way to yourNEXT property investment.

The ability to purchase a property depends on providing the required deposit and being assessed as having the serviceability to repay the loan. Although many of us may have the ability to make monthly repayments – particularly in an investment scenario where rent could cover a good proportion of repayments -the challenge is that many of us find it difficult to save the deposit.

Is there a solution?

This is where your first property comes into consideration. If you have held this property for a number of years it is likely your property may have increased in value.Perhaps you’ve also made additional loan payments? Either one or both of these factors may have created equity in the property.

Rather than saving the deposit, you could now borrow the deposit by using that equity as security.

So how much deposit do you potentially have in the equity of your first property?

Most lenders will provide funding of up to80% of the property value so the available equity is the amount between 80% of the property value and your remaining loan balance.

Using equity effectively

Where wealth creation is your aim you should consider channelling all your surplus funds to paying down your nondeductible debt (or place these funds in an offset account to minimise nondeductible interest).

Offset accounts can be a very effective tool for providing flexibility. Unlike a redraw facility, the funds are generally available instantaneously allowing you to withdraw the funds at any time.

This availability may allow you to move quickly with the purchase of an additional property.

Using an offset account effectively will depend on whether your first property is an investment property or your home. Your individual circumstances will determine the suitable approach to maximise your financial position. As your finance specialist, we can certainly help you with that!

Negative gearing

Typically, investment properties that havebeen 100% funded with an investmentloan will result in an income loss, ie therental income is insufficient to meet theinterest and ongoing costs of maintainingthe property. This is commonly known as negative gearing. This loss can be claimed as a deduction on your income tax return.

You are also able to fund this income loss through a loan with the interest costs/charges on the loan also being tax deductible.

Rather than using your ordinary income(that could otherwise be used to pay down non-deductible debt) you could use the equity in your first property to apply for a line of credit. The line of credit could then pay for the portion of the operating expenses that are not covered by the rental income of the property.

Where to from here?

As your finance specialist, we are here to help you explore solutions suitable for your personal situation. We understand that most people struggle with the concept of purchasing an investment property when they are still paying off their ‘home’. Perhaps you’re not too sure what steps to take to put yourself in a suitable financial position to purchase an investment property? Well, you’re not alone!

We welcome the opportunity to discuss your concerns and assist you to make decisions suitable for your individual circumstances. Feel free to call the office for a chat at any time.

Understanding Capital Gains Tax

TAX TIME

It is that taxing time of the year again! If you are a property owner and/or property investor there are various tax considerations you need to be familiar with – including capital gains tax (CGT).If you haven’t been subject to CGT before it may seem complex. Let’s explore the basics…

What is capital gains tax?

A capital gain (or loss) on an asset is the difference between what you paid for it and what you receive when you dispose of it. Tax is payable on any capital gain.CGT applies in the financial year that an asset is sold and forms part of your income tax. It applies to all assets acquired since20 September 1985.

To calculate net capital gain:

• total your capital gains for the year,

• deduct total capital losses (this may include net capital losses from previous years), then

• deduct any CGT discounts or entitlements that apply to you.

The resulting total is the net capital gain that is subject to tax.

Properties subject to CGT

In terms of property related assets most real estate apart from your ‘main residence’is subject to CGT including

• rental properties (houses, apartments, home units)

• vacant land

• holiday houses and hobby farms

• commercial premises such as shops, factories and offices

Are there exemptions?

The most significant exemption is your main residence – there can be exceptions to what is classified as a main residence. Asa general rule a property is no longer your main residence once you stop living in it.You should keep records of all expenses associated with your family home – just as you would with any other property.Other assets exempt from CGT (sometimes subject to certain conditions) include:

• cars

• assets acquired prior to 20 September 1985

• collectables and jewellery costing less than $500

• personal use items costing less than$10,000, eg boats, furniture, electricalgoods

• depreciating assets

• compensation for personal injury

• winnings/losses from gambling, a game or competition prize

• shares in a pooled development fund etc

Rollovers

In the case of certain events, eg a marriage or relationship breakdown, you may be able to roll over a capital gain from a CGT event until another CGT event occurs.

It is essential you speak to your taxation specialist to determine exemptions or rollover eligibility that may apply to your individual situation.

Beware Airbnb and CGT!

Have you ever hosted Airbnb guests?Companies such as Airbnb and Stayzhave opened up a whole new world of short stay rental opportunities for some homeowners and investors, however, many people are unaware of their tax obligations. It pays to be aware!

The sharing economy is now very much on the radar of the Australian tax Office and they are using advanced data matching technology to track such income.

The ATO advises: When people rent out all or even part of their residential home, they become liable for CGT when they eventually sell their house or apartment.CGT applies to the proportion of the floor area that is set aside to produce income and the period it is used for that purpose.

Property owners could also be at risk of fines for unpaid income tax if they don’t-declare extra income for short term rental arrangements.

What does the future hold?

There was a recent proposal for the government to halve the current 50% CGT discount and restrict negative gearing on investment properties. While this was rejected by the government there is potential for property investment strategies to be back under the spotlight in the future or under a different government. Property investors should keep abreast of proposed changes.

Remember, as your finance specialist is our job to keep up to date with finance and property investment market changes. Have a question? Then give us a call today!

Girl power! Single, female FHBs on the rise

There’s an interesting property market trend underway… Let’s all welcome the single, female first home buyer!

Statistics show Gen Y females are the fastest growing group of mortgagors, taking out almost one-quarter of mortgages in Australia in 2015. In fact, almost twice as many single women are buying homes as single men!

Why are women going it alone?

There has been a significant shift in the lender market – 30 years ago single women often suffered discrimination when applying for home loans. Fast forward to 2017 and itis financial merit, not gender, that underpins qualification for a home loan.

In the same period, there has also been sizeable growth in participation rates of women in the workforce1. However it seems that social change has been a key driver for young women to seek their own financial independence – many no longer see a need to wait for the right guy to come along!

Women now think about property as part of their life plan. In a recent survey2 87%of 18-34-year-old women listed owning a home and paying it off as a lifetime goal(compared to 79% of men).

The survey also revealed Gen Y women can be more financially literate thanGen Y men showing:

• 81% of females understand variable interest rates (60% for males)

• 49% rank home ownership over having children (14%) and getting married (5%)

• 73% list paying off their home loan sooner as the most important factor when taking out a loan

What do you need to know?

Regardless of gender, there are important points to consider when buying property on a single income. FIRST, on your list should be talking to us – your finance specialist.

The initial challenge is determining how you will save the deposit and manage repayments on your single income – there is still an average pay gap of 16%between women and men in equivalent full-time roles!

If possible, aim to save at least 20% deposit to avoid lender’s mortgage insurance(LMI) plus extra for stamp duty, legal fees, moving costs etc.

Other important considerations:

• Do you know your credit score? Either get a copy of your credit report ORwe can get it for you.

• Know your borrowing capacity BEFORE you commence. Maybe a smaller, cheaper property is a viable way to start?

• Check your eligibility for a first home owner grant (FHOG) in your state.

• The ‘bank of Mum and Dad’ is another growing trend! If family members are in a position to help we can assist you to explore options such as a family guarantee or gifted deposit.

• We can arrange pre-approval of your loan. This assists you to act quickly AND sticks to your budget.

• Perhaps consider becoming a ‘rentvestor’? Rental income on an investment property may help pay down your loan while you rent where you want to live or live at home and save.

• We can explore loan features suitable for your individual circumstances as a single buyer and your long-term financial goals.

• What about pooling your resources?Individual applicants have been slowly shrinking since 2012 as young buyers team up with siblings, parents or friends to get into the market.

• Don’t forget income protection insurance – so VERY important when buying on a single income. Don’t leave your financial future to chance!

First home buyers are VERY much in the news – there is growing pressure for our governments to do more to help them into a property. Measures to abolish stamp duty and increase FHOGs are already underway in some states.

As your finance specialist it is our job to keep up to date with the latest financial market changes so give us a call TODAY!

How do we get our finances under control?

We often observe clients (especially busy parents juggling careers and kids) leaving the management of their finances on the back burner. Mixing sleepless nights with long work hours can mean that even though our bills magically get paid each month, the dirty ‘b’ word – ‘budget’ – is rarely spoken or thought of.

Let’s change that and… start talking about it!

Q. How do you create a budget?

A great starting point is to contact us for our BUDGET ORGANISER! Print it off so you and your family can sit down, list your expenditure and income and see where your money is spent and where you could save.

This could take as little as 20 minutes BUT could potentially save hundreds if not thousands on debt repayments and other expenditure. Isn’t that worth it?

Ensure your budget is realistic by estimating future expenses from past expenses and track your regular and incidental costs for a few months. Cater and plan for these expenses.

Q. What are the next steps?

Money is often blamed for being one of the main causes of relationship problems and breakdowns… or is it?

Many experts agree that it’s really a lack of communication skills and compromises.

Honest and open communication between partners is a key component of controlling joint finances. With both parents often now working, each person may have their own credit card or other personal debt. It is essential you are both honest about debt and where you are spending your income.

Discuss your joint personal dreams and long-term financial goals. Looking at the bigger picture helps you decide if you are both prepared to make sacrifices to your current lifestyle (however small) to achieve long-term wealth. Remember you both need to be financially responsible AND financially satisfied. More often than not, the common financial ground can be found through communication.

Once you have agreement on your family budget you can REALLY start to manage your finances.

Remember, if you have credit cards or personal loans, payments MUST be made on time to avoid negatively impacting your credit history.

Q. What if we don’t understand HOW to control our finances?

If your budget is complex then seeking independent advice from a financial specialist is another important step in taking control of your finances. As your finance broker, we can help you with that. A trusted adviser can often identify areas of improvement you sometimes aren’t aware of.

Q. What if our finances are OUT of control?

Many of us fall behind with our finances at some point but it’s important to be proactive when we’re struggling to pay our bills.

The most common mistake we see is that clients with money problems pretend it’s not happening. They avoid calls from their lender and won’t even tell us – their finance broker – about their financial stress.

Taking control involves more than creating a budget – it is essential to face the problem and do something!

By law, credit providers have to offer temporary financial assistance when we have proven financial hardship, eg if someone in the family has an accident resulting in a temporary change in income your lender may approve a temporary financial assistance package. Subject to approval, banks can offer a short-term freeze on consumer accounts to help you during the time of hardship.

Getting your money under control isn’t hard, but it DOES take discipline to regularly sit down and honestly evaluate your finances.

Start that budget TODAY and speak to BOTH your partner and to US!

This financial year make ONE new resolution:

Don’t let money control you: you control your money.

Are you prepared for the unthinkable?

If you’re a homeowner or are looking to purchase property, it is important to consider not only how you would meet your basic financial commitments, but how you would maintain your quality of life should you or your loved ones become gravely ill or suffer a serious injury.

Protection for such life events can come in many forms, from many providers and with relative affordability. But choosing the right type of protection and understanding what you’re covered for can be complex and confusing.

All insurance provides us with a financial safety net. The type(s) of insurance required for our needs requires some careful consideration to ensure coverage in a variety of scenarios.

Total and permanent disability insurance – what does it mean?

A serious injury or illness can make it difficult or impossible for you to continue to work. If this happens, you will need to find a way to support yourself and your family for life. Total and permanent disability cover (TPD) is almost always purchased together with life cover and can provide a financial safety net for such an unforeseen event.

TPD insurance provides cover if you are totally and permanently disabled. Your insurer will define TPD as either when:

• You can’t work again in any occupation, or

• You can’t work in your usual occupation

TPD insurance helps cover the costs of rehabilitation, debt repayments and the future cost of living.

Each insurer will have different definitions of what is and isn’t considered to be totally and permanently disabled. Being off work for a year is NOT ‘permanently disabled’. You need to ask lots of questions and read the fine print so you know exactly how your policy defines your cover.

Do I need TPD?

When deciding if you need TPD cover you need to consider:

• Your level of private health insurance

• Other types of life insurance you currently have, especially through your super fund

• How much income you and your family will need to live if you can’t work for a while or forever!

Why do I need life insurance and/or TPD insurance?

Any choice of cover depends entirely on an individual’s circumstances. Term life insurance is probably the most economical form of protection for your family in the event of your death. TPD insurance covers serious and permanent disablement but DOES NOT cover temporary disabilities or many traumas – these are best covered by income protection and trauma policies.

Cases of total and permanent disablement are relatively small in comparison to other conditions. If you have limited dollars to spend on insurance you will need to weigh up whether to spend it on this form of cover.

Insurance through super

Consider buying TPD cover through your super fund because it may be cheaper and you may be automatically accepted. Many super funds offer disability cover. To see what level of cover you have through your super fund:

• Check your member statement

• Contact your super fund for information

• Read your product disclosure statement (PDS)

What cover do I need?

As we accumulate liabilities and have dependants our need for insurance increases. But as we approach retirement we are more likely to have accumulated assets, no liabilities and our children have probably left home. The need for life or permanent disability insurance is then reduced. Insurance needs will vary over time and should be reviewed at least annually.

You need to consider…

Usually, only ONE TPD benefit is ever payable to an individual and payment of a claim for TPD may void your death cover. After a payout you may become uninsurable and no longer able to obtain life, TPD, trauma or income protection insurance covers from any insurer. It is important to ensure you have sufficient cover to enable you to live out your remaining life on the proceeds of the claim.

Beware of so called ‘cheap’ offers of insurance. Small premiums usually mean small amounts of cover. In the event of your death or an accident, the cover may be grossly inadequate to meet your family’s needs.

Fortunately, there are providers who have built products specifically for people in your situation.

Tips to help you manage your mortgage

• Be realistic about what you can afford to borrow and repay.

• Understand that borrowing calculators only give you approximations. Obtain all the facts.

• Planning to renovate or have kids? Check your plans aren’t going to stretch your budget too far.

• Cover your income and mortgage with insurance in case of illness, death and disability as well as unemployment.

• Reconsider the kind of property you want to buy if your budget looks too tight.

• Borrow a loan amount that allows you to save money for emergencies.

• Don’t rely on what the figures say you can borrow – ensure you can make the repayments if interest rates rise.

Other factors to consider if you’re struggling with your mortgage repayments could be:

Change your mortgage to an interest only loan for a few years

Switching from the principal and interest payments to interest only mean you have a lot less to pay each month but this should only be a temporary measure – you still need to repay the principal. You should resume regular repayments as soon as you can. For example, on a $350,000 loan over a 30-year term at 4.50% the repayments on a principal and interest loan are $1,773. On an interest only loan, the repayments are $1,312 – saving $461 per month. Remember if you choose an interest only loan you will not be paying any principal off your home, so don’t leave it too long before you sort out your budget and get back to paying your principal as well.

Fix the rate for a couple of years

Most fixed rates have factored in future interest rate rises.

However, if you need peace of mind, some help with budgeting and the assurance of knowing your actual monthly repayments for a period of time, then this option may suit you. There are some great, very low 3 and 5-year interest rates at the moment. Call us for our best rates.

Line of credit

If you have equity in your home you can apply for a line of credit (LOC) to help get you through a period of financial stress. For example, if your home is valued at $500,000 and your debt is $300,000, you have equity available that can be borrowed against for other uses provided you can still service the repayments. This works by using the line of credit to pay the shortfall of your mortgage repayment. The interest will be capitalised in the LOC until you start repaying the debt. Be aware that this option does require a degree of discipline to ensure your current equity is not ‘frittered away’ on nonessential expenditure.

Take a repayment holiday

If you’re ahead on your loan repayments why don’t you take a repayment holiday? Some institutions allow you a period of time where you do not have to pay your usual monthly mortgage payment if you are ahead on your repayments. This money could be better used to pay a consumer debt, maxed out credit cards or unexpected bills. It could also be handy if you temporarily lose your job.

Remember, these options are all only possible considerations. Decisions about a suitable option for your individual circumstances should be made in consultation with your finance specialist.

Getting ahead financially through debt consolidation

Generally, your home provides the best opportunity to secure the most cost effective debt available in any given market. As your home is used as security against the loan, it provides the lender with additional confidence to lend money to you and at a lower interest rate than a credit card or personal loan.

Credit cards, store loans and personal loans are provided without security and therefore lenders charge much higher rates of interest. The reason for this is, in the event of your defaulting on a payment, they are unable to immediately gain access to your assets to seek repayment of their loan.

In the majority of instances, you will be financially better off utilising your home loan given the potential interest savings.

It is important to remember that rather than continually spending borrowed money:

• good budgeting,

• spending within your means, and

• controlling your discretionary spending

are keys to getting ahead financially.

A good savings and investment plan combined with a planned debt reduction strategy are important tools in securing your financial independence. That’s a key component of our service offerings to you.

Our goal for you…

Is to ensure you are minimising the interest payable on all debt, not just your home loan, and to ensure you have a planned approach to be able to pay off your debt.

Debt consolidation – how it works

As part of your debt reduction strategy, together we may consider consolidating all your debt (personal loans, car loans, credit card balances…) into one loan. This involves taking multiple debts and consolidating them into one loan with a much lower average interest rate. Your home loan usually has the lowest interest rate.

Example:

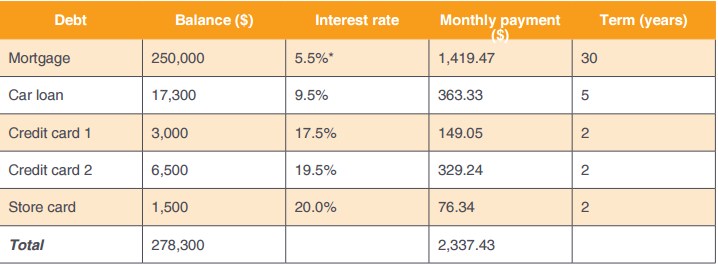

Debts before consolidation

Getting ahead financially through debt consolidation

By consolidating the above debts into an existing home loan at an interest rate of 5.5% this could achieve a number of objectives:

1. Reducing your total monthly repayments

In this example, consolidating all debt will reduce the monthly repayments from $2,337.43 pm to $1,580.16 pm (a whopping saving of $757.27 PER MONTH!) and helping you to regain control of your finances.

2. Reducing the total interest paid across all debt if paid off at the same rate

Ideally, you should maintain your previous monthly payment of $2,337.43 and aim to reduce your debt more quickly to take advantage of a lower average interest rate. If you do this you are likely to pay off your total debt (including your mortgage) in under 18 years (instead of 30 years) and save $115,041 in interest.

$80 million in unclaimed life insurance. Where are YOUR important documents?

When faced with the sad loss of a loved one the bereavement process can be an incredibly difficult period. It is certainly not a time when we need additional stress.

One of the earliest tasks that often needs to be completed is locating important documents such as insurance policies, wills, funeral plans etc. If your loved ones don’t know where to look can you imagine the distress this can cause?

What if you passed away and your intended beneficiaries could not locate your life insurance policy? According to ASIC, there is around $80 million of unclaimed life insurance in Australia. Perhaps this proves just how difficult it may be at times to locate documentation – or if many loved ones even know a policy exists?

Life changes… We move house, forget to update addresses, relationships change or we take out insurance and don’t inform anyone. Future difficulties for our loved ones are certainly NOT what any of us intend when we take out a policy or plan to assist them financially in the event of our death.

Traditionally we have used filing cabinets, briefcases, safety deposit boxes, fireproof safes, external hard drives and flash drives to preserve and protect our important documents and data. The downside of most of these methods is that documents and data can be damaged, stolen or lost.

It may be that nobody even knows WHERE important documents are held or WHAT documents exist.

Jamie Wilson’s story…

In Jamie Wilson’s case, the difficulty of this task was the catalyst for creating a business that would ultimately deliver a worry-free digital solution to file storage for important documents.

When his father was diagnosed with terminal cancer, Jamie’s trauma was compounded when he realised there was no ONE safe place where he could access all of his dad’s most sensitive documents including his will, insurance papers, passwords to online accounts and other confidential information.

As a result, an accountant turned entrepreneur Jamie was driven to create Your Digital File. Given his own experience, it is not just business – it’s also personal.

Jamie worked tirelessly for three years with the world’s top online security experts to fulfil his dream to help people survive such worst-case scenarios. His online solution was realised with the launch of Your Digital File – a single source of confidential documents stored in a cloud-based virtual vault that is only accessible to those with explicit permission.

Jamie says, “While I never stopped in my quest to develop and patent the most secure document storage platform ever created, there were moments I faltered.”

At one such critical juncture, Jamie met a young woman whose father had died suddenly. Because she could not find evidence of any insurance and didn’t know of his superannuation accounts she and her mother were facing foreclosure on their home.

For Jamie, this meeting reaffirmed the urgency and necessity of his mission. He also became determined to set an entry price affordable for all families.

Security is important

Nobody can predict when tragedy will strike – be it illness, natural disasters like flood or bush fires or criminal activity such as identity theft or computer hacking.

Your Digital File is like a ‘fortress in the cloud’ where only you and your designated family and/or loved ones can access critical, confidential information such as wills, trust deeds, power of attorney documents, funeral plans, family photos, passwords, letters and more.

“Your Digital File makes this process simple while also providing unmatched security and a full audit trail that preserves the integrity of documents,” says Jamie.

From as little as $1 per month, you could provide the peace of mind that YOUR loved ones will have access to everything they need.