articles

Superannuation

Out of sight, out of mind

Outside of ownership of your home your Superannuation account is generally one of your largest investments.

So why is it that a large majority of Australians fail to manage this Important investment?

Is it because your employer is usually the one making regular contributions and therefore it is out of mind? Or perhaps it’s because it will be a long time before you need to access the funds?

Whatever the reason it’s not surprising that a survey of baby boomers in 2015 revealed 35% were ‘completely unprepared’ for retirement, 51% were ‘somewhat prepared’ and only 14% were ‘financially prepared’.

It’s astonishing the percentage of Australians that realise – often when it’s too late – that they won’t have sufficient savings to pay off their mortgage or fund their retirement.

Most of us can expect to spend 20+ years in retirement but for many of us, the money will run out after 10 years. It is never too early to start preparing financially for your retirement! This means taking charge of your financial security sooner rather than later.

Your super account

In July 2005 new laws were introduced that allowed you to take a greater interest in the performance of your superannuation (super) fund. These changes allow you to have control over where your super contributions are deposited. Most super funds now have a number of investment options with different risk profiles depending on your stage of life and tolerance for risk. Each fund will perform differently over time. Regardless of the fund, you choose you will need to regularly review your fund’s performance and risk profile to determine if they are still appropriate for your personal circumstances as these will change over time.

Remember, your super is YOUR money!

Quick quiz…. Tick the box if you can answer these questions.

- How much do you currently have in your super account?

- Do you have more than one account? If so, how many.

- What investment options do you have for your super?

- What fees apply? How much are your total annual fees?

- How much does your employee contribute annually?

- Do you have insurance cover included with your super? If so, what type(s)

- How much are you paying for this insurance and what is the level of cover?

- When can you access your super?

How did you go? If you could answer all or most o these go to the top of the class, In fact, 6 out of 10 people don’t know how much super they have AND 45% of working Australians have more than one super account2. Does that sound a little more like you?

There is no time like NOW to take a greater interest in your super.

In reality, the earlier you engage with your super the more you may be able to improve your financial future.

Other options

Taking a more active interest in your super is only one of the many steps you could take towards achieving financial independence. Establishing a household budget that creates surplus funds for investment is always the first step. Your surplus funds could then be applied to a range of options from starting to pay down your mortgage, investing in an additional property to making extra contributions to your super. Remember you don’t always need to pay off your home before you buy an investment property! You may use the equity in your home as security if you are able to demonstrate a capacity to service the loan.

Take charge of your own financial security NOW! After all, if you’re not willing to take responsibility who will?

What would happen to my mortgage if I lost my job?

We were recently asked during a loan application process “What would happen if I lost my job?”

It’s scary to think about this possibility when you’re just starting the journey of home ownership. It is important however – after all a mortgage is usually your biggest investment.

So how do you avoid being one of the 39% of Australians who don’t have enough savings to maintain their lifestyle for 3 to 6 months?

We’ve all heard the famous saying ‘Failing to plan is planning to fail’. We all need to be prepared beforehand rather than be blindsided when the unexpected occurs. This requires taking action sooner rather than later.

Q. What can you do beforehand?

Before you do anything you need to determine how long it may take you to find a new job. This will often depend upon the type of industry you work in and whether you will need to look for a new career. You should add some extra time to be safe. Don’t be surprised if it takes 6 months to a year – or even longer. Now that you have estimated how long you may be out of work, what are your normal living expenses, including your new mortgage payments?

Once you know how much you need in reserve, establish a savings plan to build this over time. Potentially the best way to do this is with a loan product that provides for either an offset account or a redraw facility. The objective would be to set aside additional funds that are paid into either the offset account or the mortgage with each repayment. Within a reasonable period of time your safety net can be established.

In the unforeseen event of losing your job you would be able to withdraw regular amounts from the offset account or mortgage redraw facility to fund your living expenses.

Q. What if it takes too long?

If you don’t think you will be able to establish the safety net within a reasonable period of time you could look at taking out an insurance policy that could partially help.

Consumer credit insurance

This insurance generally does cover you for involuntary redundancy but the cover does have a limit with most being less than 3 years.

Importantly, this insurance normally needs to be taken out at the time of the mortgage and will only cover the mortgage repayments. It will not cover your other everyday expenses.

Income protection policies

Some income protection policies cover involuntary redundancy. You need to be careful though – there are more policies that don’t than do cover redundancy. They also generally have limited cover – most likely for only a period up to 12 months. Most income protection policies only cover you for up to 75% of your income so there will be a shortfall.

Q. What if I fail to plan?

We’ve heard the saying ‘Closing the door after the horse has bolted’ but all might not be lost.

The first and most important thing you should do is contact us immediately, even if at this stage you only feel redundancy is looming. We can explore your options.

Lender assistance

Some lenders have a hardship policy that may allow you to reduce or defer repayments for a period. This could range from 2 to 13 months depending on the lender when you entered into your loan and your individual circumstances. Your eligibility has to be approved by the lender and conditions will apply.

If your request is refused you have the right to make a complaint to your lender or lodge a complaint with the Financial Ombudsman Service (FOS).

Clearly, the best option is being well prepared as this will provide greater certainty at a time that will already be stressful.

Keeping score. Do you know your credit store?

Your credit report (also known as a credit file) is one of your most important financial assets. Safeguarding this report is an important part of the finance application process.

The Privacy Act was amended in December 2013 to allow financial institutions to share your credit liability and repayment history including whether your payments have been made on time OR NOT.

All this information is held in your credit report.

Your credit report contains a history of your credit related financial information within the past five years including:

• credit inquiries/applications, monthly repayment history, overdue debts and credit accounts, payment defaults (also known as clear outs), account open and close dates, bankruptcy, court judgments and court writs, commercial credit information and public record information.

Your credit score (sometimes referred to as a credit rating) is calculated from your credit report.

Did you know that a score of less than 500 will severely affect your ability to gain finance from many lenders? Do you even know what your score is or how easily it can be affected?

What is a credit score?

Credit scoring is a mathematical assessment of the data included in your credit report. The credit score is calculated by the credit reporting agency using a number of complex formulas. The score shows the likelihood of your defaulting on your credit payments within the next 24 months. While the score range may vary between credit agencies as a general rule scores range from 0 to 1,200.

The higher the credit score the lower the risk that you will default. A score of around 550 will indicate that you are an average risk.

Credit reporting

In Australia there are two main credit reporting agencies:

1. Veda

2. Dunn & Bradstreet

Your credit report is very important as it provides the information used to calculate your credit score.You can access a copy of your personal credit report through www.mycreditfile.com.au – normally at no charge. You will have a credit report if you have applied for any form of credit. This can include:

1. phone, internet or utilities contracts

2. credit cards

3. residential or personal loans

4. hire purchase

So what factors affect my credit score?

The exact formula used is a closely guarded secret that not even the lenders know.What we DO know is that there are some behaviors that will affect your score that YOU can control, fore example:

1. late payments

2. overuse of credit

3. limiting the number of credit applications

I didn’t realize that was recorded on my credit report!

I didn’t realize that was recorded on my credit report!

We have had clients lodge a loan application with us only to be rejected due to a poor credit score.

When we investigated the case we found there had been multiple credit inquiries listed in a short period of time. What the clients didn’t realize was that every time they were offered(and accepted) a new credit card (at their local grocery store and service station) these services were individually lodged as a credit inquiry.

Our clients had also sought preapprovals from various lenders while they were searching for a new home. These preapprovals were also listed as a credit inquiry. When the time finally arrived to acquire their home loan, it appeared they had submitted many applications for a range of credit over a very short period. This history resulted in a low credit score and subsequent rejection by the lender.

Surely the lender can understand what really happened?

Surely the lender can understand what really happened?

Unfortunately many major lenders are now treating credit scores as a black and white decision.

If your score is too low then the loan application will be rejected – no questions or discussion!

What should I be doing?

Be conscious of the importance of your credit report and make sure you meet all your credit obligations. If you are considering refinancing in the next couple of years, be aware of all agreements,preapprovals and inquiries you make (where you sign a privacy agreement) as these will generally result in an entry on your credit report where they will stay for 5 years.

Should I pay cash for a car?

Two of our favorite clients recently shared their story about one of their past financial ‘mistakes’. Early in their married life – 20 odd years ago – Glenn and Toni paid cash for their first car together. Was this a good move? We explore the answer below…

Two of our favorite clients recently shared their story about one of their past financial ‘mistakes’. Early in their married life – 20 odd years ago – Glenn and Toni paid cash for their first car together. Was this a good move? We explore the answer below…

Just to give you some background – Glenn and Toni were in early married life and renting. They had no investment properties, no credit card debt, no mortgage or other lines of credit. Both were working full time earning professional salaries.They received a lump sum redundancy payment (lucky them!)

They had plenty of cash available and wanted to buy their first car together. And they wanted a new car. They went to the bank.

What advice did they receive? They were advised not to incur any debt as they had managed fine without it to date!

So they took their $30,000 in cash and bought a car.

Now if Glenn and Toni had taken that $30,000 over 20 years ago and made their first property investment, would that have been a better move? Would their financial position be a little different today? Most definitely YES!

Q. Why shouldn’t I pay cash for a car? Won’t the interest on my car loan really add up?

Many people are scared of debt. They think all debt is ‘bad’debt. But while the value of your shiny new car decreases the moment you drive out of the showroom, property investment is a long term strategy aimed at building wealth.

The equity you build in your property over time will far outweigh the interest you have paid on your car loan. PLUS you start building a good credit history. This history is required to be approved for a home loan in the future.

Q. We can’t afford to buy where we would like to live so what’s the point?

For many people it makes more financial sense to buy an investment property before buying a home to live in. Your chosen suburb might be too expensive for you right now.However the capital gains on an investment property could help you fund another deposit for a property further down the track.

Look for affordable properties in popular rental areas. Start small and don’t overextend yourself.

Q. What if we don’t have enough for a deposit?

Glenn and Toni would have had more than enough deposit for a home loan 20 years ago AND would most likely have also been approved for a car loan! As your trusted finance specialists we can help you explore deposit options.

Did you know for every $10,000 you have in cash, you can borrow approx $90,000 towards a property?

Already a home owner? With the equity you have built AND the cash you would have paid for a car, an investment property maybe more possible than you think!

So why not have your car and property too?

You don’t need to be wealthy to invest, but you do need to invest to be wealthy

If you think you have to be wealthy to invest in property you might be mistaken! In fact the skills and experience you’ve gained managing a budget on a lower income could make you a better property investor than some big spending high income earners.

If you think you have to be wealthy to invest in property you might be mistaken! In fact the skills and experience you’ve gained managing a budget on a lower income could make you a better property investor than some big spending high income earners.

We often meet people who are hooked on the good life: living in expensive suburbs, driving fancy cars, frequently dining out and taking overseas holidays. Many will have built their wealth through a successful investment strategy but you may be surprised to find out how many don’t have adequate savings for retirement or redundancy, let alone a solid investment plan.

Lower income earners are often the ones who knuckle down and save. Careful budgeting, motivation and discipline are very important attributes of successful investors. If you have had plenty of practice stretching your dollar further and living within your means, you might already have what it takes!

Lower income earners can often have a more realistic view of investment risk.

They know they need to do something to get a better financial future. Many people are hesitant to invest because they just don’t like having debt. That’s a fair call… but you can reduce your risk.

Will you be part of the wealthier 20% OR will you be in the 80% of Australians who will need to rely on government support at retirement?

Why people do it

Around 20% of Australians invest in property for:

• potential capital growth

• rental income

• tax benefits

• long term wealth creation

They:

• tend to consider property one of the more solid, less volatile forms of investment because you can actually touch bricks and mortar

• like the feeling of getting ahead financially

• don’t want to be one of the 80% of Australians who have to rely on the aged pension when they retire

Why others DON’T

Around 80% of Australians don’t invest in property because they:

• don’t like debt

• need more information to take the first step

• don’t know how to ensure their investment property is not threatened by interest rate rises or unreliable tenants

• aren’t sure how to pick appealing properties for goodrental return

• don’t realise they can probably afford it – even if theydon’t have a big salary

• think all debt is ‘bad’ and haven’t realised aninvestment property could make them money and even pay for itself

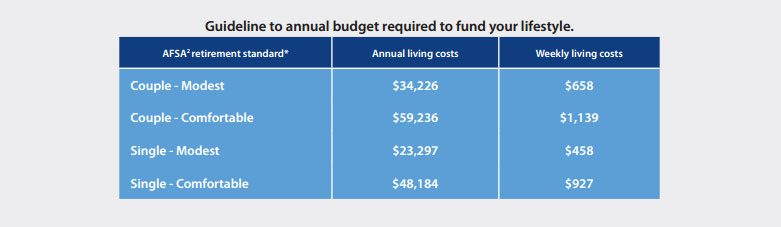

Did you know at the last census it was revealed 67% of men and 76% of women aged over 65 were living on less than $600 per week? Below is a guide to the income required for either a modest or comfortable lifestyle in retirement.

If you don’t act, nothing changes. Remember:

• You most likely have some good equity in your existing property

• Interest rates are at a current all time low

• Financial institutions off er a variety of investment loan products to suit various investor situations

Online fraud – Tips to protect yourself online

Do you remember waiting in line at a bank during business hours to withdraw money from your account? If you were late you risked having NO MONEY for the weekend! Doesn’t that now seem so incredible?

Do you remember waiting in line at a bank during business hours to withdraw money from your account? If you were late you risked having NO MONEY for the weekend! Doesn’t that now seem so incredible?

The growth of online banking and transactions of all types has exploded in recent years. We now enjoy 24/7 online access to our funds as well as global shopping from the comfort of our homes.

Technology has changed our lives immeasurably, however it has also led to a new type of personal risk – online fraud.

Online fraud refers to any type of fraud scheme that uses online services to conduct fraudulent solicitations, fraudulent transactions or to transmit the proceeds of fraud to financial institutions.

Banks and financial institutions spend millions on sophisticated software systems to protect our accounts. It is for this very reason criminals instead focus directly on customers to trick them into disclosing confidential personal information.

However, there is a lot YOU can do to protect yourself. Being aware of the risks will help you make better choices about HOW you use the internet.

Here are some simple steps you can take to minimize your risk:

Install security software and set it to scan regularly. Reputable software will protect you from viruses, malware and spyware and alert you to threats. It is equally important to pay attention to security settings on mobile devices or any device that has an internet connection.

Scareware often appears as a popup advising your computer is infected. It prompts you to purchase (useless and possibly dangerous) software to repair it. Check your security settings and ensure your popup blocker is on.

Turn on auto updates –date against the latest threats.If you have old software no longer supported with updates from the manufacturer -uninstall it.

Be wary of clicking links or attachments in emails or on social media sites. As a general rule, if you don’t know the sender – DELETE.

Review and adjust your privacy settings on all social media sites. Not sure how? Google ‘How do I set my privacy settings on Facebook?’ (LinkedIn, Instagram etc).

Use strong passwords and change them twice a year.Yes, we know they are the bane of life for many of us! But they can certainly help prevent criminals accessing your computer or other devices that hold personal information.

If a computer offers to save your password when you log in say ‘no’.Scammers can use malware to locate passwords stored in your PC.

Use different passwords for each account.And whatever you do,DON’T store a list of passwords on your computer!If you must,write them down and hide them well away from your computer.

Secure your wireless network.Assign a password so that any attached device must know the password to connect.

Try not to use WiFi hotspots or public computers for sensitive internet usage.Always clear the history, close the browser and logout after use.

Practice safe shopping

When shopping online check you are on a secure page.The web address will begin with HTTPs and display a locked key or padlock icon. But beware, scammers can reproduce symbols to make a fake site look secure. If in doubt, don’t purchase. Better to be safe than sorry.

Always keep a copy of your transaction. If you suspect a scam or fraud contact your bank immediately.

NEVER send your bank or credit card details by email – ALL transactions should be through a secure web page. Conversely,banks will NEVER send you an email asking you to reveal your account details or password. Ignore or delete any email that looks suspicious or contact your bank by phone to confirm legitimacy.

Our online world has provided convenience at our fingertips we could never have imagined 15 years ago. In many ways it has changed our lives for the better. Being proactive about online security will help all of us stay safe online.

0% car finance – How they hide the interest YOU aren’t paying

There’s nothing like the smell of a new car! In fact, official figures show Australians bought a record number of new cars in 2015,eclipsing 1.1 million sales for the fourth year running.

There are a number of ways to finance a car. In recent years we’ve frequently seen zero or low percent car finance advertised. Many people find this an enticing way to purchase their next new motor vehicle.

But have you heard the old saying ‘you don’t get anything for FREE’? Well the reality is – you don’t!

So who is really paying for you to have an interest free car loan?

You guessed it… YOU ARE!

How is the interest hidden?

In today’s new car market zero or low rate finance deals are being offered by an ever increasing number of car dealers.Before you rush out and sign on the dotted line, it’s important to understand what is happening behind the scenes with these low rate finance packages.

Firstly, there is no doubt the interest rate being advertised to finance the vehicle purchase is legitimate. How are they able to offer this rate? These finance offers are typically part of what the industry calls a ‘subvention’ finance program as the interest rate for the finance package is being subsidized by the dealer or manufacturer out of the profit made on the sale of the car.

How does it work?

Let’s look at a simple example to illustrate how subvention works.

Assume you purchase a new $35,000 car which is being sold in conjunction with subvention finance at an interest rate of 1.9%.The loan term is 48 months with a nil residual at the end of the contract.

Depending on the lender who is providing the finance, the ‘sub-vented’ amount in this scenario may be anywhere between $2,500 and $2,900. In other words, once the transaction has been finalized, the car dealer or manufacturer must ‘pay’ the sub-vented amount to the lender to enable a realistic rate of return to be made on the finance contract.

It is now clear the dealer needs to make a larger margin on the car to be able to pay the sub-vented amount to the lender and still maintain their normal margin.

What does this mean for you?

Chances are you may have been able to negotiate a larger discount on the asking price if the purchase was not subject to subvention finance.

Remember also: The higher the purchase price of the car, the more you will pay for items such as GST, stamp duty and luxury car tax (if applicable).

What are my other options?

A more prudent approach is to negotiate on the basis of a cash sale with the car dealer leaving the low interest rate finance offer out of the equation. It is not unrealistic to obtain a discount of 8% to 10% off the asking price if the sale is not subject to a sub-vented finance arrangement.

We often find once a discounted purchase price has been negotiated, those clients who then arrange finance through us at ‘normal’ market rates typically end up paying lower monthly repayments (thus lower total repayments) over the term of the finance contract than they would through obtaining subvention finance.

Why not just pay cash?

Well you could but you certainly won’t get any return on your investment. Could you perhaps better invest your cash elsewhere?

At the end of the day the old maxim ‘there is no such thing as a free lunch’ certainly applies when it comes to zero or low rate car finance deals.

First home buyers – The new generation is knocking at the door

If we believe research and the media, Generation Y is seen as being far more interested in an indulgent lifestyle than mortgages. Well guess what? The oldest Gen Ys are now turning 35 – and they are the NEW generation of first home buyers (FHBs).

If we believe research and the media, Generation Y is seen as being far more interested in an indulgent lifestyle than mortgages. Well guess what? The oldest Gen Ys are now turning 35 – and they are the NEW generation of first home buyers (FHBs).

According to a leading provider of lender’s mortgage insurance(LMI) Gen Y borrowers account for 20% of its current portfolio – and they have only recently reached an age where they are seeking mortgages!

Here are some surprising statistics when comparing Gen Y to previous generations.They will:

• live longer

• work longer – as retirement and pension age are pushed back

• average 4 careers and 17 employers in their lifetime

• dominate employment by 2020 – making up 42% of the workforce

Yes! That’s 4 years away.

Gen Y and employment

Gen Y has often been given a poor score card on the employment front. In fact they are the most educated generation in history.However they do tend to graduate with a lack of practical workplace skills – so they can be under prepared for employment.

This is largely due to growing up in a more affluent society – many haven’t NEEDED to work – and parents have happily supported them through tertiary education so they can focus on studies. As a result, early working years can sometimes be challenging and ever changing for Gen Y.

The life stages that define adulthood and independence have shifted for Gen Y. They are leaving home, starting full time employment, getting married, having babies and getting a mortgage later in life than other generations. But they are NOW arriving!

What do FHBs need to know?

It pays for all FHBs to understand the criteria that lenders use to assess their suitability for a home loan.

Some parents are in a position to assist their children by lending or gifting a deposit for a home. What a fabulous start! So imagine the shock – and it happens – when despite (say) a $50,000 deposit a lender declines the home loan application as the young buyers do NOT meet the criteria to service ongoing loan repayments.

So where do you start?

Firstly we suggest you call us for a chat BEFORE you do ANYTHING.Recent research shows 62% of Gen Ys are very or extremely likely to seek out advice from an experienced person in a particular field. It’s interesting that despite their online lives they actually like to TALK to someone when it comes to finance.

Trust is also important to Gen Y. Why? As a generation targeted relentlessly through multiple mediums it makes sense – when it comes to important decisions – that

Gen Ys seek advice from a trusted source over marketing hype.

Top tips to be mortgage ready

• Get a copy of your credit report

Your credit report is an important part of any finance application process. You need to know your ‘credit score’ BEFORE you begin a home loan application.

• Pay your bills on time

Your repayment history is a key factor in your credit report so the earlier you pay your bills the better.

• Establish a savings history.

This refers to a diligent savings history over time – not one big deposit! If you are a consistent saver a lender may assess you as more likely to be reliable with repayments.

• Do you need those credit cards?

Lenders consider the LIMIT on your credit card(s) when assessing your borrowing capacity -even if the limit is unused!

• DON’T shop around for loans.

Did you know that every time you inquire about a credit card or a loan it impacts your credit report?

• Avoid job-hopping

Frequent changes of employer MAY be a red flag to a lender.If buying your first home is on your radar, chat to us BEFORE changing your job or career.

As your finance specialist it is our job to assess your personal situation and explore any areas that may need attention BEFORE you begin the home loan application process. Our aim is to make your FIRST experience as a home owner as smooth as possible.

Planning for retirement – Will you have enough money?

Did you read our quarterly question in this issue? 48% of our survey respondents have an investment property! That’s music to a finance specialist’s ears – it’s satisfying to hear those people have a financial strategy that could lead to a more comfortable retirement.

66% of respondents also said they are worried about having enough money in retirement. This is a concern for many of us as almost 80% of Australians over 65 receive an aged pension. For 66%of those the pension is their main source of income. Coincidence?

So have YOU started thinking about retirement? It is NEVER too early to start planning for retirement – but it can certainly be too late.

So have YOU started thinking about retirement? It is NEVER too early to start planning for retirement – but it can certainly be too late.

Where do you start?

And when should you start? Firstly, you need to focus on the lifestyle you want in retirement and then how you plan on getting there.

What if your plan changes?

That’s fine. You can make goal adjustments along the way. In fact,a retirement plan shouldn’t be a ‘set and forget’ strategy. Chances are your imagined needs in your 20s may look quite different by the time you reach your 50s.

A good starting point is to calculate how much you need to provide for comfortable retirement years.

What is a comfortable lifestyle?

For most of us this means being able to pay bills without financial stress, enjoy a few holidays, maintain a house and car and an occasional indulgence. You will generally require 60-80% of your pre-retirement income to lead the type of active life you probably desire.

It was previously assumed the first ten years of retirement would be your most active – and most costly. With longer life spans and an increase in the chance of health or mobility issues this could change.

What should a plan include?

There is no ‘one size fits all’ plan for wealth creation. If you are in your 20s and plan to retire at 65 your options may be more diverse than if you’re approaching 50.There is no ‘one size fits all’ plan for wealth creation. If you are in your 20s and plan to retire at 65 your options may be more diverse than if you’re approaching 50.

Superannuation

Many Baby Boomers will outlive their superannuation savings.While younger generations will have more time to maximize super balances at retirement they may also have significant HECS debts.This was generally not an issue for previous generations.

As you approach retirement years salary sacrifice, a transition to retirement strategy or property investment through a self managed super fund (SMSF) could help build your superannuation balance.

Property investment

Property has long been considered a proven road to personal wealth yet only around 20% of Australians successfully invest in property outside the family home. But there may be more than one way to get a foot on the property ladder:

Save a deposit – Budget and stick to a savings plan. Gen Ys living at home should maximize the opportunity to save and invest. Increase savings each time you get a pay rise.

Ask your parents to help – There are several ways parents might help children into their first property including a cash gift/loan or acting as guarantor. There are also new mortgage products such as a family pledge or family guarantee.

Use rent as a savings plan – A continuous rental history of 12 months may be taken into account when assessing your ability to service a loan.

Co-ownership – Perhaps explore investing with family or friends?

Already a home owner? Access the deposit for your NEXT property by using the equity in your current home or property.

The earlier you start planning for retirement the greater your chance of living the comfortable retirement most of us desire.

What worries you the most financially?

We asked you… “When it comes to your finances, what worries you the most?”

We asked you… “When it comes to your finances, what worries you the most?”

We recently surveyed our client base and asked them to nominate their top 3 areas of financial worry.

Why did we do this?

As your finance specialist it is important for us to know what concerns our clients the most. Your feedback provides us with valuable information on how we can assist you most effectively towards a more secure financial future.

Below is an overview of the survey results and the top ten nominated finance worries…

How does this compare with your own situation?

Q. When it comes to your finances, what worries you the most?

1. Having enough money for retirement- 66%

2. Being able to maintain the lifestyle I enjoy – 42%

3. Cost of living/household expenses – 31%

4. Will our children ever be able to afford to buy a home? – 27%

5. Level of debt (credit cards/loans etc) – 21%

6. Too little savings for emergencies – 19%

7. Changing financial markets and home loan products – 15%

8. Lack of a financial plan -14%

9. Being able to cover the costs of educating/supporting my children – 12%

10. Struggling to pay the mortgage or rent – 11%

It’s not surprising that retirement funds and future lifestyle were top of mind for most of us.

Q. Tell us about your household:

• Single income household – 42%

• Double income household – 50%

• Children living at home – 36%

• No children living at home – 35%

• Have a mortgage – 65%

• Have an investment property – 48%

• Renting – 9%

What do these statistics tell us?

Results were ballpark across demographics. This would indicate worries are similar regardless of income, dependents , home ownership or living arrangements.

It was great to see 48% of respondents have an investment property! This is a great start to any retirement strategy.

Lastly, we asked our clients:

Q. If and when interest rates increase what increase do you think you can manage without mortgage stress?

• Could manage 2% – 33%

• Could manage 1.5% – 9%

• Could manage 1% – 26%

• Could manage 0.5% – 15%

• Could manage 0.25% – 13%

• Could NOT manage any increase – 3%

Obviously the actual amount of any increase will be dependent on the size of your mortgage and the change in interest rate. As a guidance average $430,000 mortgage at 5.68% would equate to an extra$68.48 per month at a rate increase of 0.25%

There were 33% of respondents who indicated they could manage up to a 2% increase. That’s a good sign! This is the ‘buffer’ most lenders take into account when assessing your ability to meet loan repayments.

Worryingly 3% of respondents said they could not manage any increase and 13% could only manage 0.25%. If you feel this could be you TALK TO US TODAY.

We can assess your current situation and see if we can assist you with strategies to add breathing space to your repayments before any future rate hike occurs.

Do you know your interest rate?

If you don’t or if you haven’t reviewed your finances in the past 18 months you could be missing out on a better rate. We encourage you to contact us to book a finance review!

We will be providing some great articles in this and future issues with tips on how to manage many of these areas of concern. Make sure you look out for them each issue!