articles

9 WAYS to purchase your race horse…

9 WAYS to purchase your race horse… or holiday, pool, new car, renovation – or whatever!

Gone are the good old days of ‘lay-by’ – remember that? The ‘olden days’ of buying something you couldn’t afford. It was the original form of delayed gratification and budgeting for things we wanted – something our children and grandchildren will never know anything about. Perhaps even some of our Gen Y readers?

Do you have a big ticket item you would really like to purchase but you’re not sure about how to pay for it?

Do you have a big ticket item you would really like to purchase but you’re not sure about how to pay for it?

Let’s take a look at a few ways, starting with the most obvious:

- Set up a budget and start putting a little extra aside regularly until you have saved enough to purchase your big-ticket item. (Yes, we know it’s BORING!)

Let’s face it, many of us really aren’t big fans of delayed gratification, however, if you are most comfortable with this method there is absolutely nothing wrong with that. In fact, more people should follow your example. Set up a separate savings account, ask your employer to direct a portion of your salary each week into the new account so there’s no temptation to spend it. Then watch it grow!

Most of us are more the INSTANT GRATIFICATION type. We just can’t wait. We want it and we want it NOW! So most of us will then…

- put it on the credit card (accruing from 15%* or more interest and potentially taking many years to pay it off), or

- take out a personal loan (interest rates may vary from around 5% up to 27%1 depending on factors such as the amount, your credit score, term of the loan, security etc).

Both of these options are going to get you that item right now.

The disadvantages?

Unless you pay your credit card off within the 55 days free interest period, the cost for both of these options will end up being much more than the ticket price in the long run.

WARNING: Both options would not be high on our recommended list.If your credit card has an interest rate in excess of 15% and you take 5 years to pay off the debt then your $20K holiday could end up costing you as much as $30,000 or more!

Of course, you MIGHT experience an unexpected windfall? You could…

- pay for your big ticket item with an inheritance from a long lost cousin you’ve never met, or

- win big at the races!

Good luck with both of those options.

What about using your home loan?

There are several ways you can do this. You can:

- use your redraw facility (if you have one)

- use your offset account (spare cash)

- use the existing equity in your home (set up a redraw or split loan facility)

or

- refinance all your debt AND your home loan to include the cost of the big-ticket item.

The advantage of using your home loan?

The advantage of using your home loan?

Adding a large ticket item to your home loan is likely to give you the lowest interest rate available as the item is secured to your home. And let’s face it – interest rates are pretty good at the moment – it is the cheapest way of buying money today.

The disadvantages?

If you fail to make additional payments over a short period of time to cover the additional loan you risk taking many more years to pay off your home and can even pay a lot more than the original cost of the item.

The major risk? If you take a very long time to pay off the debt, you are increasing the total interest repaid – thus the total amount of the big ticket purchase. It could end up costing you a lot more than you really wanted to spend.

If you really want to make a big purchase this way, you MUST pay off all debts as fast as possible!

Regardless of the item you want to purchase, we always recommend you do two things:

Regardless of the item you want to purchase, we always recommend you do two things:

- Come and talk to us before you sign anything. We may have some finance options you haven’t yet considered.

- Ensure you review your budget to maximise repayments and minimise the total cost of any money borrowed.

Improving your odds…

The Melbourne Cup is not only known as the race that stops a nation, but also the most difficult race to pick a winner given the field comprises the best of the best. You can, however, improve your odds when picking a home loan!

The odds

Just because a horse has the shortest odds on the day does not guarantee it will ‘WIN’. Similarly, a home loan with the lowest interest rate does not mean it is going to be the cheapest or best home loan for you.

No two horses are the same

It’s difficult to pick the winning horse as there are many factors contributing to the likelihood of a horse winning: track conditions, weather, horse size, handicap weight, jockey experience, barrier draw and probably even a little bit of luck.

Home loans are similar to horses in that there are many varying attributes:

- interest rates

- introduction rates

- application fees

- valuation fees

- transaction fees

- monthly account fees

- no monthly fees, and

the list goes on, making it confusing to select the winner.

Choosing a home loan does not have to be a gamble – like betting on a horse.

- Improving the odds

While the best way to improve your odds of picking the winning horse may be to obtain a trainer’s tip or rumor, comparing mortgages is a little easier – especially with our help! While a low-interest rate might give the appearance of being a winner, it does not necessarily factor in all the additional costs associated with the loan.One way of determining the TRUE cost of a loan is checking the comparison rate. We have access to comparison tools to quickly and easily review rates and products across different lenders. Speak to us and we will do the legwork for you!

One way of determining the TRUE cost of a loan is checking the comparison rate. We have access to comparison tools to quickly and easily review rates and products across different lenders. Speak to us and we will do the legwork for you!

- Comparing the odds?

While the comparison rate can be used as a guide it is also very important to consider the features of each loan. We are familiar with the different products and can make sure that we are comparing similar products with the features you actually need and want. - It is not all about the odds

The cheapest home loan is not necessarily the best home loan for you – one of the key factors in home loan selection is matching the home loan to your goals and objectives – both short and long-term.

There are many other considerations other than the financial cost that needs to be explored. What are your future financial goals? What features might you need to best support them such as access to a redraw facility or offset account or bundling with other financial products? - Picking a winner

While picking a winning home loan is not as difficult as picking the winning horse, consulting with a lending specialist will definitely improve your odds.

We present you with a range of options, explain the different products and then YOU make the final decision. Even as experts in this industry we can spend up to 10 hours or more comparing finance for you and working out the correct structure for both now and your future requirements – and we know what we’re doing.

Call the office today to find out more about the field of home loans currently competing to win your business.

We hope you have enjoyed this month’s read, had some luck on the Cup and we look forward to hearing from you soon.

MORE THAN THE BIG 4

What do YOU know about the Australian lender market?

The ‘Big 4’ banks have maintained a dominant profile in the complex and ever-changing Australian finance market – just think about how often you read about them in the news! And it is this high profile in our everyday lives that has contributed to a perception that all lenders are the same.

Is that what you think? In fact, Australian consumers are spoilt for choice…

Did you know there are over 40 banks (plus multiple foreign bank branches) and around 60 credit unions and building societies in Australia as well as a number of non-bank lenders?

Of course, if you are receiving this email you would already know that one of the key advantages of using our services – as your finance specialist – is that we have access to a range of lenders when seeking a loan that may be suitable for your individual circumstances. We are not tied to just one lender and their available loan products.

So what is the difference between lender types?

Banks

• Banks are authorised deposit-taking institutions (ADIs) and can use their own funds to provide home loans.

• They provide integrated banking packages including savings, transaction accounts and credit cards.

• Wide branch networks provide additional service but also contribute significantly to overhead costs.

Second-tier banks

• Second-tier banks are those that are not part of the Big 4. They include a surprising number of household names such as ING Direct, Bank of Queensland, Macquarie Bank, Suncorp, ME Bank, Bendigo and Adelaide Bank, St George, Bankwest, Citibank and AMP Bank.

• While some are now owned by the big banks it is worth considering their competitive offerings.

Building societies and credit unions

• These non-profit cooperatives are owned by the people who use their services so each member is both a customer and a shareholder.

• Rates can be very competitive.

• Member deposits are used to fund loans.

• Like banks, they offer a wide variety of banking facilities with a focus on customer service.

• They are regulated in the same way as banks.

Non-bank lenders

• They do not hold an Australian banking licence so cannot accept deposits, therefore, they source wholesale funding via investors, financiers, trusts and even the Big 4 banks.

• They do not have the overheads of an extensive branch or ATM network.

• The appeal for customers has been competitive interest rates, more flexible lending criteria(eg for low doc or non-conforming loans) and higher loan to valuation ratios (LVRs). Low rates are however often balanced by higher fees.

• An emphasis on customer service, faster loan processing times and responsiveness are other selling points compared to the big banks.

• Tend to have limited products and services so they may not be suitable for all your financial needs.

So do we recommend the Big 4 to clients?

The Big 4 are strong competitors with broad product ranges so if they have a solution suitable for your individual circumstances then of course we do. However, we may also recommend second-tier banks or non-bank lenders if their product, pricing and services are ideal for you.

Most importantly, you will have the confidence of knowing we only recommend lenders that have provided a good personal experience for other clients.

Is switching loans a suitable alternative for me?

Your home loan is usually your largest financial commitment. We understand that changes in interest rates can have a big impact on your monthly repayments and how long it takes you to pay off your loan.

Switching loans might cost you thousands in early exit fees and other required fees, but it could possibly SAVE you thousands of dollars as well.

• But how will you know?

• How will you compare each new lender’s offering against others?

• What new conditions will accompany a new loan?

When you contact us we will compare your existing loan with other lenders’ products.

Our goal for you is to find out:

‘Is the cost of switching loans worth the potential interest rate saving?’

We will use the following steps:

1) We shop around for you

We use our financial calculators to compare interest rates, fees and features of your current loan with several other home loans available in the market.

We might also be able to negotiate (on your behalf) a discount below the listed interest rate, especially if you have a large loan. We will talk to your current lender and tell them you are thinking of switching to a cheaper loan offered by another lender.

They may offer to reduce the interest rate or suggest a cheaper ‘no frills’ loan. This could save you significant switching costs. Often, by using us, your mortgage specialist, we can secure a better rate than if you try to negotiate this yourself.

2) We research the potential savings from switching

Our role is to calculate the fees you will be charged if you change loans, plus other expenses you may need to pay eg lender’s mortgage insurance (LMI).

We will show you how long it will be before you start making savings after the cost of switching. We can also compare the minimum repayments of potential new loans.

3) We compare home loan features against your existing loan

We determine a range of potential loans that may be suitable for your circumstances and check them against your existing loan. We will compare the features such as:

• the ability to make extra repayments

• having an offset account

• having a redraw facility

You may pay more for a loan with extra features and flexibility so we will need to determine if these features are important to you and whether they are worth the extra expense.

4) You decide, then we help you take action

We will present to you the potential cost savings and differences in features between loans.

Please note:

You will only reap the potential savings if the new loan stays cheaper over the long term. The longer it takes for a switch to save you money, the greater the chance that the interest rate savings may fade.

Your savings can be used to pay off your new mortgage more quickly or make lower repayments to alleviate some of your current financial burden.

If you decide you would be better off switching loans, then let’s take action together!

Should we stay… or should we go?

There is no end of financial advice on preparing for retirement: superannuation, investments, tax minimisation, age pension eligibility, funding your desired lifestyle – the list goes on. All this advice highlights the importance of planning ahead – the sooner you start the better prepared you will be.

One of the biggest decisions for many retirees is whether to stay in the family home or purchase smaller or ‘retiree’ accommodation. It may be their most significant decision both financially and emotionally.

Downsizing is on the move

Between 2009 and 2014 one in four Australians aged 55-64 moved to a smaller property1. It is expected this percentage will increase as more Baby Boomers move into retirement.

As a result, there has been increased demand for housing suitable for retirees such as villas, townhouses and units. Growing competition for limited stock in many established areas has increased prices – in some locations, the cost of a villa can be as expensive as a three bedroom house. This trend may continue. But beware – the reverse can happen in an off the plan situation. Some off the plan properties are coming in under purchase price and lenders have restricted lending in certain areas.

Is it better to plan ahead?

In the years prior to retirement, many homeowners find themselves with substantial equity in the family home and fewer expenses as kids (hopefully!) leave home. It’s an ideal time to consider using the equity in your home to buy that retirement property now. In the years leading up to your retirement, the rental income and possible tax benefits will help pay for your property.

With the potential benefit of positive movement in the housing market – and now having two properties – this may place you in a good position to increase your retirement nest egg if you choose to sell your family home when you downsize. Depending on your situation you may even be able to keep the family home as an investment.

Why downsize?

The decision may be as simple as living in a property that is easier to maintain, closer to family or one that supports your lifestyle choice – many grey nomads LOVE being able to lock up their small pad and hit the road!

Selling could also release money for other investments that provide you with additional income in the future. This may give you more choices in retirement and avoid an alternative equity raising options such as a reverse mortgage on your current property.

Look before you leap

Before putting your home on the market you should consider the following:

- Understand your reasons for selling. Don’t just consider short-term needs – factor in potential long-term needs.

- Explore ALL the implications of selling your house – financial and otherwise.

- What are the advantages to YOU? If you’re moving to be near family what will happen if they move elsewhere?

- Smaller isn’t always cheaper. Explore all the costs of moving and maintaining a new home. Will you be ahead?

- Have you sought financial advice? How will funds from the sale of your home affect your Centrelink assets and income tests? Will selling impact your age pension?

- You may miss people, activities and services in your current area if you relocate to another region. Make plans to re-establish yourself or keep contact with your social circle.

- You will need to cull a lifetime of possessions. ‘Letting go’ can be difficult. Try doing without items or living in a confined area of your house for a bit to see how you adjust to ‘smaller living’.

Ultimately, downsizing from your family home should provide you with a whole new way of life that is better than the one you left behind. With careful planning and a clear understanding of your future goals, you could be well on the way to making it your best move yet!

20% of retirees will run out of money!

Research shows about 20% of retirees are spending their super at ‘unsustainable’ levels. What does that mean? It means about one-fifth of us will most likely outlive our retirement savings. And…

This percentage is predicted to rise as more of us enter retirement! Recent research shows 54% of pre-retirees (55 and over) are financially unprepared for retirement and only 8% are financially prepared.

So WHY are retirees running out of money?

• One of the primary reasons is simply because we are living longer. Australia is in the top 5countries for life expectancy – if you’re aged 64 now you can expect to spend about 20 years in retirement.

• Medical advancements have also meant that many of us are more physically and socially active in retirement than previous generations. That’s a wonderful bonus for us but NOT so beneficial for our super balance!

• There has been a seismic shift in expectations of what ‘modern’ retirement entails – we now want a slice of the ‘good life’ after years of working. This is having a significant impact on how retirees use their savings.

• Lastly, it has been suggested that our cultural tendency towards a ‘she’ll be right mate’ attitude has lulled us into a false sense of security.

Minimum drawdown rates

The government mandates a minimum amount retirees should draw down from their superannuation pension each year. Data supplied from super funds shows that over the past decade 50% of these superannuation pensions are being drawn down at above these minimum rates. Interestingly, the balance ‘size’ did not appear to affect people’s decision on how much to withdraw.

So… Do you think YOUR super will go the distance?

What is the alternative?

We know you’ve heard this before BUT… the majority of retired Australians rely on the age pension. In 2017 that amounts to a maximum of $669.60 per fortnight each for couples and $888.30 per fortnight for singles.

You can certainly see that reliance on the pension as your sole source of income would probably mean your retirement may not look quite like what you had planned.

So what steps do you need to take NOW?

If you fall into the ‘pre-retiree’ category (and let’s face it, that’s ALL of us who haven’t yet retired –no matter WHAT age we are now) then planning is the key. The earlier you start, the better! Depending on your current age this may involve a short, medium or long-term strategy. Statistics show 44.5% of homeowners aged 55-64 had an outstanding mortgage debt in 2013-14 – almost triple the level of 1995-96! Clearly, paying down debt and maximising our retirement savings are key considerations for most of us when planning the lifestyle we want in retirement.

Remember, you are never too young to start thinking about your future. Time and capital growth don’t wait for anyone so the time to start thinking about your retirement is right NOW!

We would welcome the opportunity to discuss your financial future at any time – call us for an appointment TODAY.

There are many wealth creation options available to help fund your future retirement. The most effective option? Taking ACTION now is a good start!

Top 15 ways to OWN your home sooner

Before taking action on any of the below ‘Top 15 Ways’, we recommend you speak with a finance specialist. Call the once for more information on any of these 15 suggestions.

1. Pay the first home loan installment as soon as you settle

2. Review your loan at least every two years and negotiate a cheaper rate with good flexibility

3. Ensure you use a mortgage offset account for your savings and understand how to use it wisely

4. Split your loan – fix a portion and leave the rest variable for flexibility

5. Avoid redrawing money off your mortgage at all costs

6. Don’t lower your minimum regular payment if interest rates fall

7. Set higher repayments

8. Make lump sum repayments or regular mini lump sum repayments

9. Pay your loan fortnightly rather than monthly

10. Set a budget and reduce any unnecessary spending

11. Pay loan fees up front

12. Align your repayments with your income cycle

13. Make extra payments as often as you can – preferably set up an auto payment to do this

14. Talk to us about loans that offer features without a charge

15. Check your loan fees and negotiate where possible

Your interest rate may not be what it seems

At a time of almost constant (even daily) changes in the finance world – and an absolute overload of information online – it’s easy to see why some consumers are becoming ‘switched off’.

A recent study about financial literacy found 57% of respondents didn’t know that banks determine actual interest rates – not the RBA. It also found 36% didn’t realise if they reduced the length of their loan they reduced the amount of interest they paid!

What does that tell us? Well…

It tells us there are potentially a LOT of people who could be enjoying savings on their home loan AND other loan products – if only they knew how.

So how important is financial literacy?

Let’s face it, many of us find the ever-changing world of finance and banking complex. And yes…pretty dull. But a lack of interest in educating ourselves about our home loan – usually the BIGGEST financial commitment we have – is often costing us money!

It’s interesting that the same survey found 74% of us don’t know what a comparison rate is…

Do you? And what SHOULD you know?

Comparison rates

Lenders are legally required to display a comparison rate when advertising most loans. This is a tool to help identify the true cost of a loan by combining all components into a single percentage rate. It includes:

• the loan amount

• the loan term

• the repayment frequency

• the interest rate, and

• the fees and charges connected with the loan

For example at the time of writing this article, one lender was advertising an interest rate of 3.78%. Sounds good, doesn’t it? But the comparison rate was 4.36%. Now that’s a difference of $580 interest each year for every $100,000 of borrowing you have. That is a little over $2,000 per annum on the average Australian loan.

The mandatory comparison rate was initially introduced to stop lenders advertising very low-interest rates that lured borrowers into loans that actually ended up costing more than they expected. A low rate may look attractive at first glance but it doesn’t always mean it is the lowest rate.

While the comparison rate can be used as a guide it is also important to consider the features of the loan and how these may benefit your particular circumstances and future goals. The rate alone should NOT be your sole consideration when obtaining finance.

Remember, whether you are looking to buy your first home, upgrade, downsize, refinance, invest in property or even buying a new car, as your finance specialist it is our job to do the research for you to determine the loan product most suitable for your circumstances.

Mortgage brokers now account for more than 50% of the home loan market. There is a good reason for that! We have to constantly adapt with the times, the policies and the changing finance market to provide more than just a loan service.

We are your finance concierge, educator, confidant and specialist working for YOUR best finance options without the trickery of advertising low-interest rates as a lure for your business.

If you are thinking of reviewing your current loan – DON’T do it alone!

Our role as your finance specialist is to help you make the best financial decision for your personal situation. We consider such factors as:

• how long you are planning on having the loan

• your employment status, age, and financial position

• what job/personal circumstances may be happening in your future

• your family situation and potential future financial expenses (known and unforeseen)

AND we look at more than one lender for your solution.

Gen Ys will earn over $2 million dollars in their lifetime

Finishing school and moving into adulthood afford so many opportunities and experiences these days. For many young adults, travel is high on their ‘to do’list. For others, it is having the time and independence to be able to try new and more adventurous hobbies and activities like rock climbing, skydiving or bungee jumping. The ‘no fear’ attitude is elevated and the list of adrenalin activities is endless.

Young adults have their whole life ahead of them. They are just starting life in the adult world, however many mistakenly believe they are invincible.

But what if something goes wrong?

Not many in their 20s (or even their 30s) consider the worst. While being active is a key mitigator in preventing many lifestyle-related illnesses, the activities they participate in can sometimes increase their chances of suffering an injury.

‘Would you want to miss out on$2 million of income potential?’

The average Australian male retires between the ages of 61.5 to 63.3 and 59.6 for women. This means that we work for around 40 years of our life. If you were to have an accident at age 25 preventing you from returning to work, this would equate to about 36.5 years of income (and potentially about $2 million ) that you would not be able to earn.

There is now more talk that most of us will not be financially able to retire until we are 70. That’s another half a million dollars of unprotected income. And who knows what the retirement age will be in another40 years?

We all think that it won’t happen to us, but sometimes it does.

• We all know someone in their 20s or early 30s who has suffered cancer or some other type of permanent illness.

• Many of us also know someone who has had a life debilitating accident at an early age that has not allowed them to return to their normal type of employment.

Think about your activities, your expenses and what you will risk if you have not covered your income.

We all know that most Australians are underinsured. We encourage you to NOT be one of them.

It is our greatest fear, in the world of responsible lending, to take a call from any of our clients who have had an accident or illness and have not taken our recommendations on protecting their health, wealth, debt and income.

The older you become the harder insurance is to obtain, so NOW is always the best time to investigate your insurance options.

Please talk to your friends and family who may be in similar stages of their lives to encourage them to consider their insurance options as well.

Using the equity in your home for investment purposes

If you are already repaying your own home or another investment property, you may be able to use the equity you have built up to purchase the additional property. Let’s use an example to explain this process.

If you are already repaying your own home or another investment property, you may be able to use the equity you have built up to purchase the additional property. Let’s use an example to explain this process.

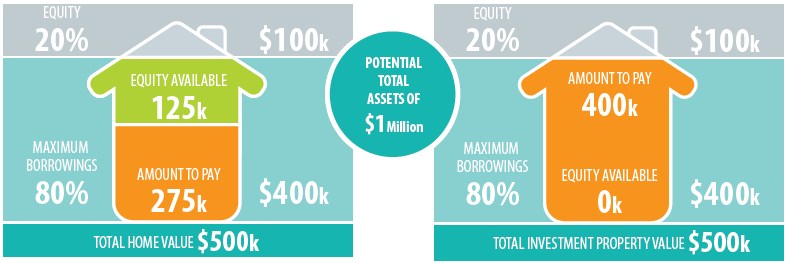

Your lender is going to require that the loan amount is less than 80% of the value of the property unless you want to pay lender’s mortgage insurance(LMI), so to keep things simple we will assume that you can only borrow 80%.

From our example on the right, you have $250,000 sitting in your home loan that could be used to purchase an investment property. You have two different options available in terms of structuring your loans:

1. Establish a line of credit, or

2 Apply for a standard term loan with a redraw facility or offset account where the remaining equity will be invested until required.

Potential property portfolio

Let’s now assume that you purchase an investment property worth $500,000. You again want to avoid LMI so you will need to provide$100,000 as a deposit. You also need to consider the upfront purchase costs. These vary from state to state so we will assume 5% of the total purchase price (or $25,000). This means you will need to provide $125,000 from the equity in your first property.

Your property portfolio will now look like this:

Your tenants and the tax man (through rebates) help pay for the new loan, however, sometimes there could be a shortfall to be serviced. This should be taken into account when borrowing to ensure that the loan on the new investment property and your existing property can be serviced within your budget. A margin should be included for any unexpected interest rate rises.

Then all you need to do is sit back and let the property take its course with capital gains generating some additional equity over the next seven to ten years as has been proved (even in tough times) over the last century.

Once you learn this strategy you can repeat it as often as you want, provided you can repay the borrowings.