Getting ahead financially through debt consolidation

Generally, your home provides the best opportunity to secure the most cost effective debt available in any given market. As your home is used as security against the loan, it provides the lender with additional confidence to lend money to you and at a lower interest rate than a credit card or personal loan.

Credit cards, store loans and personal loans are provided without security and therefore lenders charge much higher rates of interest. The reason for this is, in the event of your defaulting on a payment, they are unable to immediately gain access to your assets to seek repayment of their loan.

In the majority of instances, you will be financially better off utilising your home loan given the potential interest savings.

It is important to remember that rather than continually spending borrowed money:

• good budgeting,

• spending within your means, and

• controlling your discretionary spending

are keys to getting ahead financially.

A good savings and investment plan combined with a planned debt reduction strategy are important tools in securing your financial independence. That’s a key component of our service offerings to you.

Our goal for you…

Is to ensure you are minimising the interest payable on all debt, not just your home loan, and to ensure you have a planned approach to be able to pay off your debt.

Debt consolidation – how it works

As part of your debt reduction strategy, together we may consider consolidating all your debt (personal loans, car loans, credit card balances…) into one loan. This involves taking multiple debts and consolidating them into one loan with a much lower average interest rate. Your home loan usually has the lowest interest rate.

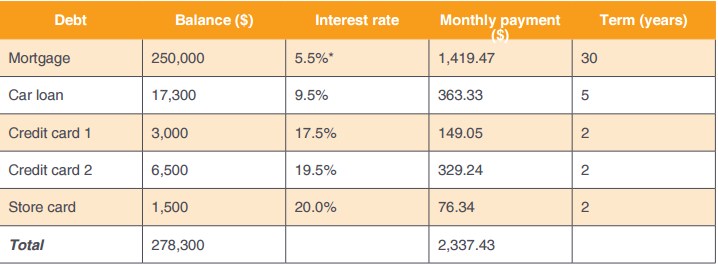

Example:

Debts before consolidation

Getting ahead financially through debt consolidation

By consolidating the above debts into an existing home loan at an interest rate of 5.5% this could achieve a number of objectives:

1. Reducing your total monthly repayments

In this example, consolidating all debt will reduce the monthly repayments from $2,337.43 pm to $1,580.16 pm (a whopping saving of $757.27 PER MONTH!) and helping you to regain control of your finances.

2. Reducing the total interest paid across all debt if paid off at the same rate

Ideally, you should maintain your previous monthly payment of $2,337.43 and aim to reduce your debt more quickly to take advantage of a lower average interest rate. If you do this you are likely to pay off your total debt (including your mortgage) in under 18 years (instead of 30 years) and save $115,041 in interest.