Using the equity

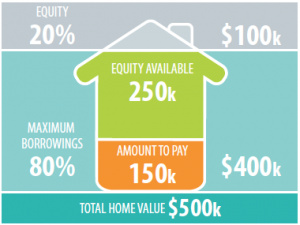

If you are already repaying your own home or another investment property, you may be able to use the equity you have built up to purchase an additional property. Let’s use an example to explain this process.

If you are already repaying your own home or another investment property, you may be able to use the equity you have built up to purchase an additional property. Let’s use an example to explain this process.

Your lender is going to require that the loan amount is less than 80% of the value of the property unless you want to pay lender’s mortgage insurance (LMI), so to keep things simple we will assume that you can only borrow 80%.

From our example on the right, you have $250,000 sitting in your home loan that could be used to purchase an investment property. You have two different options available in terms of structuring your loans:

- Establish a line of credit, or

- Apply for a standard term loan with a redraw facility or an offset account where the remaining equity will be invested until required.

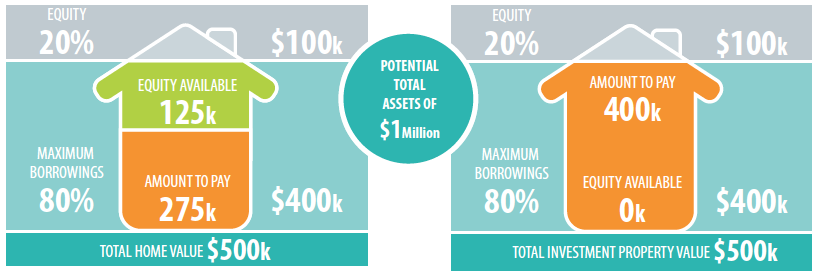

Potential property portfolio

Let’s now assume that you purchase an investment property worth $500,000. You again want to avoid LMI so you will need to provide $100,000 as a deposit. You also need to consider the upfront purchase costs. These vary from state to state so we will assume 5% of the total purchase price (or $25,000). This means you will need to provide $125,000 from the equity in your first property.

Your property portfolio will now look like this:

Your tenants and the tax man (through rebates) help pay for the new loan, however sometimes there could be a shortfall to be serviced. This should be taken into account when borrowing to ensure that the loan on the new investment property and your existing property can be serviced within your budget. A margin should be included for any unexpected interest rate rises.

Your tenants and the tax man (through rebates) help pay for the new loan, however sometimes there could be a shortfall to be serviced. This should be taken into account when borrowing to ensure that the loan on the new investment property and your existing property can be serviced within your budget. A margin should be included for any unexpected interest rate rises.

Then all you need to do is sit back and let the property take its course with capital gains generating some additional equity over the next seven to ten years as has been proved (even in tough times) over the last century.

Once you learn this strategy you can repeat it as often as you want, provided you can re-pay the borrowings.