New Car

Lots of us like to drive a new car but did you know it costs around $121 per week to finance the average small car ?

Lots of us like to drive a new car but did you know it costs around $121 per week to finance the average small car ?

Many Australians have a love affair with new cars with a record 1.14 million new vehicles sold in 2013. So are you one of those Aussies who want to buy a new car as soon as the last one is paid off? If so then let’s consider these points:

-

How many of us really NEED a NEW car every 3 to 5 years?

-

How could $121 pw make a real difference to your life?

-

Did you know you could probably afford an investment property with $121 pw?

- We know that cars depreciate in value over time and properties appreciate over time, yet we are often guilty of investing in instant gratification – such as a new car NOW – as opposed to delayed gratification – such as a more secure financial future.

Did you know that approximately 80% of Australians end up on some form of government assistance in retirement? Did you also know that ONLY 20% of Australians invest in property?

Do you think this is a coincidence? Probably not.

While many of us like to have a new car, would you consider driving your current car for a few extra years if you knew your financial situation would be improved as a result?

Just think of some of the financial advantages that could be enjoyed if you were to postpone a new car purchase. You could maybe buy some other ‘toys’ with your extra cash, have a great holiday OR you could use that extra cash to start building wealth and become part of the 20% of Australians who actually enjoy a comfortable retirement.

There are many paths to building wealth and $121 pw is usually enough to get you started. Let’s have a look at just two options for using that extra cash.

Option 1: Purchase an investment property. How do the numbers work?

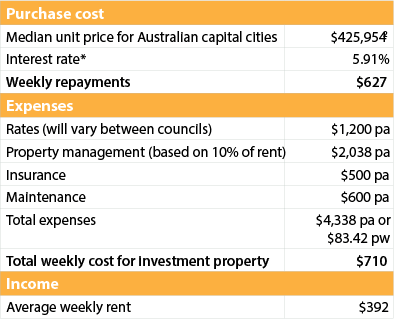

A quick check of the table on the next page shows $710 pw in mortgage expenses and rental income of $392 pw leaving a shortfall of $318 pw.

But didn’t I say it would cost around

$121 pw? Yes, but the story doesn’t end here.

By using both depreciation on the property AND claiming your finance expenses against your income you can reap a combined tax reduction of approximately $10,000 pa!

This reduces your weekly commitment to just $126 pw. You can even claim your tax refund in advance each pay cycle to help with cash flow.

Search the ATO website for the PAYG withholding variation application for more details.

Option 2: Pay off your home loan sooner.

If you are not yet ready to take the next step into the property market then why not consider paying off your mortgage even faster? If you take the median unit price in Australia of $425,954 with an interest rate of 5.91% you will be paying weekly repayments around $627. If you add the extra $121 pw to the mortgage, this will boost the repayment amount to $748 pw.

Now I’m sure you can guess this will turn into some serious savings – in fact it could take up to 7 years off your mortgage and save you a whopping $127,700+3 in interest over the life of the loan!

Is this food for thought?

So NOW what are you going to do when you pay off your car?

1. http://www.racv.com.au

2. www.apm.com.au – APM Housing Market report – January 2014

3. http://www.moneymanager.com.au

*average standard variable rate of ‘big 4’ banks